A guide to Canadian group retirement plans

Canadian employer-sponsored retirement plans work in similar ways to plans in the US, but there are some key differences to be aware of. In general, Canada’s retirement savings system is easier to navigate than in the US, with less regulatory burden thanks to a single set of governance guidelines and fewer types of accounts.

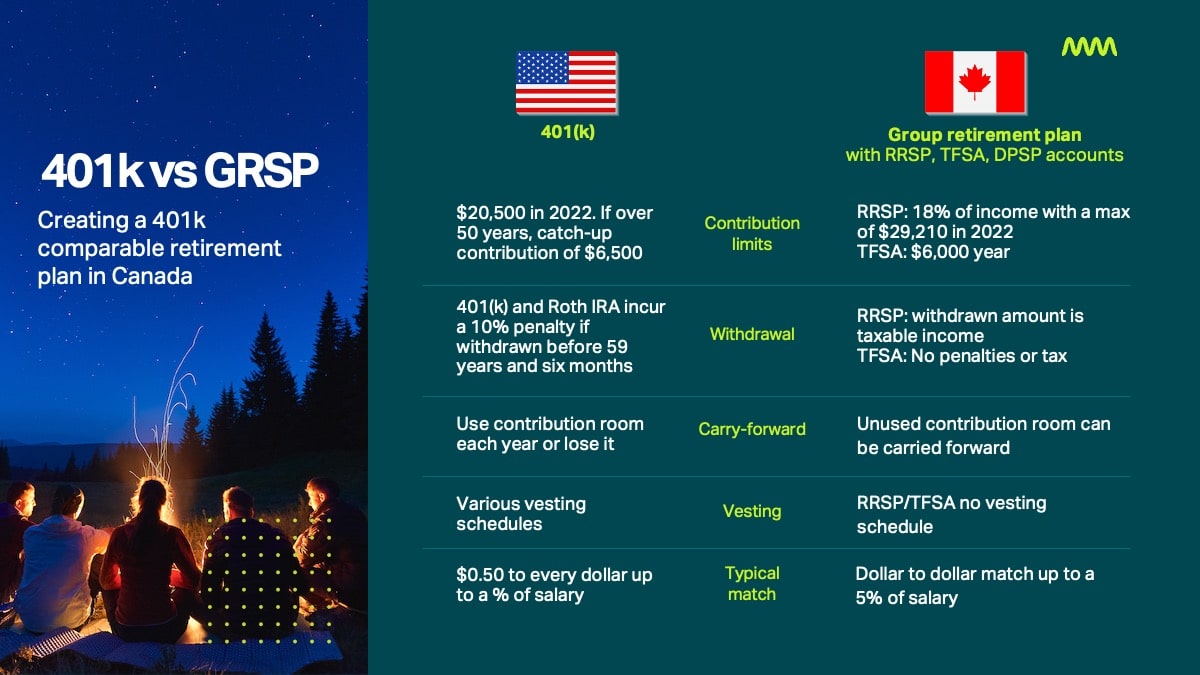

For smaller and mid-sized employers, the main Canadian equivalent of a 401(k) is called a Group Registered Retirement Savings Plan, or Group RRSP. There are also two other plan types that these employers often use, sometimes in combination with a Group RRSP: the Group Tax-Free Savings Account (TFSA), which is similar to a Roth IRA, and a Deferred Profit Sharing Plan, which allows vesting and can have tax advantages for businesses.

If you’re looking to set up retirement benefits for your Canadian employees, the first thing you should know is that today, there’s no cross-border, one-stop shop for retirement benefits serving both Canada and the US. You’ll need to choose a Canadian provider, and ideally one that will make the process easy for you from start to finish.

Here are the key things you need to know about setting up retirement benefits in Canada.

Types of plans

In Canada, most group retirement plans use these types of accounts:

- Group Registered Retirement Savings Plans (Group RRSP) are the most popular account type used in Canada. Employee contributions are tax-deductible, and employees are required to convert their RRSP to a Registered Retirement Income Fund (RRIF) by age 71, to withdraw their savings as retirement income.

- Group Tax-Free Savings Accounts (TFSA) allow employees to contribute with after-tax dollars.

- Deferred Profit Sharing Plans (DPSP) are used by for-profit companies to provide retirement benefits to their employees as an incentive. Only employers can contribute on their employee’s behalf.

Contribution limits

The Group RRSP contribution limit is 18% of the previous year’s earned income, up to a maximum of $29,210 for the 2022 taxation year. For 2022, the TFSA contribution limit is $6,000, with a lifetime maximum of $81,000.

Carry-forward rules

Unlike a 401(k), which has a ‘use-it-or-lose it’ policy for unused contribution room, both the Group RRSP and TFSA allow unused contribution room to be carried forward to future years.

Plan vesting

A vesting period is the holding period before the employee takes ownership of the funds. While 401(k) accounts have different types of vesting schedules, RRSPs and TFSAs don’t have vesting requirements at all, although some employers may choose to restrict their employees’ access to their Group RRSP savings. With a DPSP, the maximum vesting period is 2 years.

Withdrawal rules

With a 401(k) and Roth IRA, you incur a 10% penalty if you withdraw the money before the age of 59 years and six months.

With a TFSA, there are no withdrawal penalties or taxes to pay, but employees have to pay a transaction fee for the withdrawal. When employees withdraw from a TFSA, they get their contribution room back.

If employees withdraw money from their RRSP before retirement, they have to pay a withholding tax that varies by the amount they withdraw and the province they live in. They also have to pay a withdrawal transaction fee. Unlike a TFSA, the employee loses their contribution room if they withdraw from their RRSP.

Plan design

Providing matching contributions is considered a best practice for group retirement plans. In the US, employers typically match 50 cents to every dollar contributed by the employee, up to a specific percentage of the employee’s salary.

In Canada, the typical employer match is a dollar-for-dollar contribution. Cross-border employers looking to provide a Canadian plan of equal value to their US plan might choose to provide dollar-for-dollar matching but with a lower match cap (a match of up to 5% of the employee’s salary is typical).

Plan administration

Similar to in the US, Canadian employees contribute to their group retirement plan directly from their payroll. Although payroll integration isn’t as far advanced in Canada compared to the US, Common Wealth is a leader in this area with our QuickBooks Payroll integration and easy-to-use interface that works with all payroll systems. This makes plan administration easy and reduces manual work compared to other Canadian plan providers.

What you need to get started

To set up a group retirement plan in Canada, you’ll need to have Canadian bank accounts set up.

Why choose Common Wealth?

As Canada’s first fully digital retirement plan for life, our innovative platform helps employers offer their team a benefit they really value, with lower costs and a easier administration than our Canadian competitors. See how we compare to Canada’s big insurance companies and a robo-advisor based plan.

Ready to find out more?

Watch this video to see how the plan works. To learn more about setting up a workplace retirement plan that meets your business’ needs, talk with your advisor or book a consult with our team.