Canada’s fastest-growing group retirement provider

Common Wealth’s innovative technology and exceptional service have broken down the barriers for accessible workplace retirement plans.

Solving the retirement challenge

We’ve created a modern group retirement platform that helps Canadians maximize their retirement savings, while minimizing the setup and administration required for employers and advisors.

Award-winning retirement technology

2022 Innovation Award in Technology

2023 Retirement Management Innovation

2023 & 2024 Most Innovative Retirement Company

Advisors

Greater value for you and your clients

By creating the best user experience in the industry, Common Wealth is driving higher plan value across the board, translating into greater client satisfaction and growth potential for advisors.

Employers

A top attraction and retention tool

We’ve streamlined the onboarding process and plan administration for a stress-free management experience, while offering the retirement benefit every employee deserves.

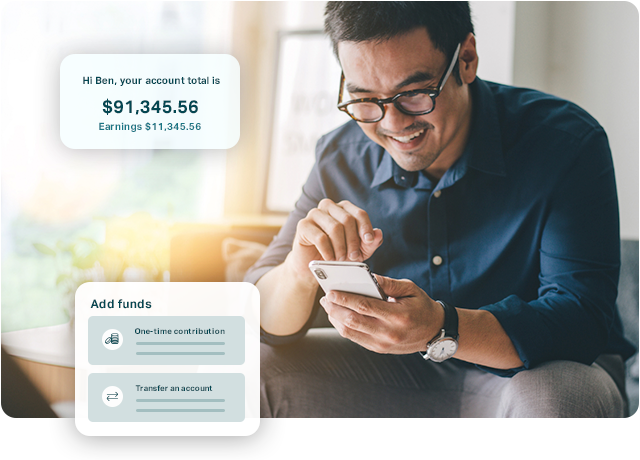

Members

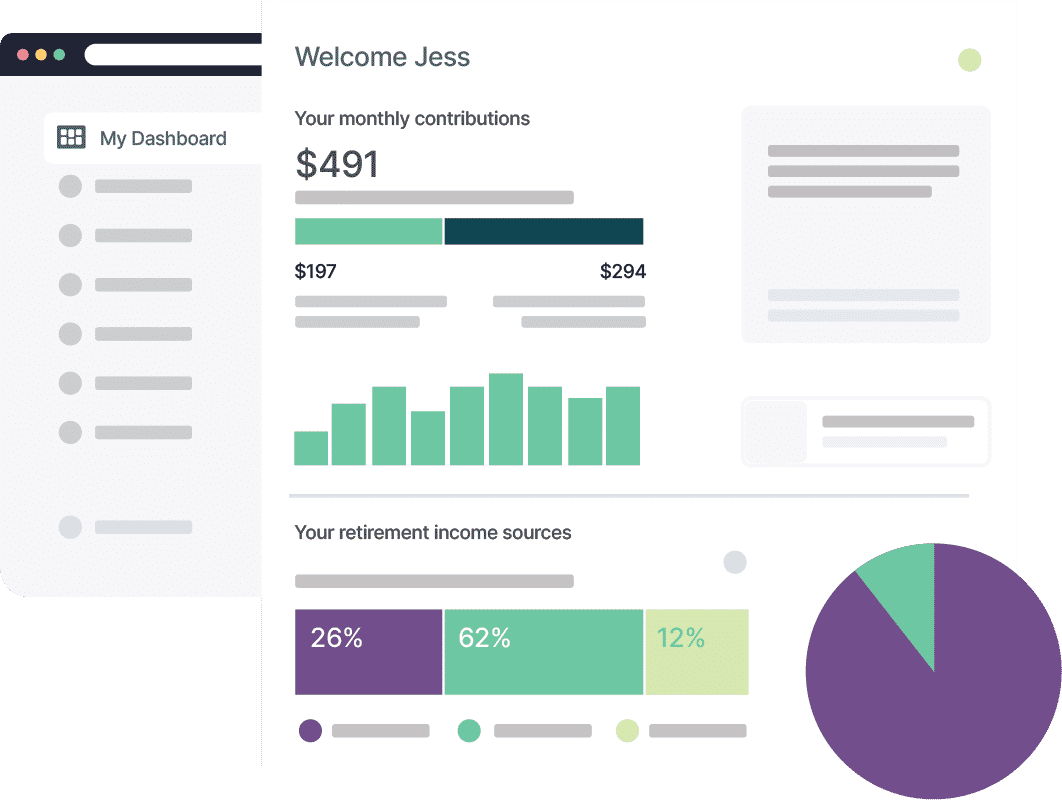

A modern plan that supports you for life

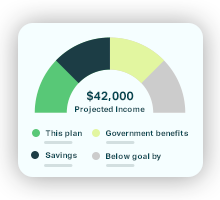

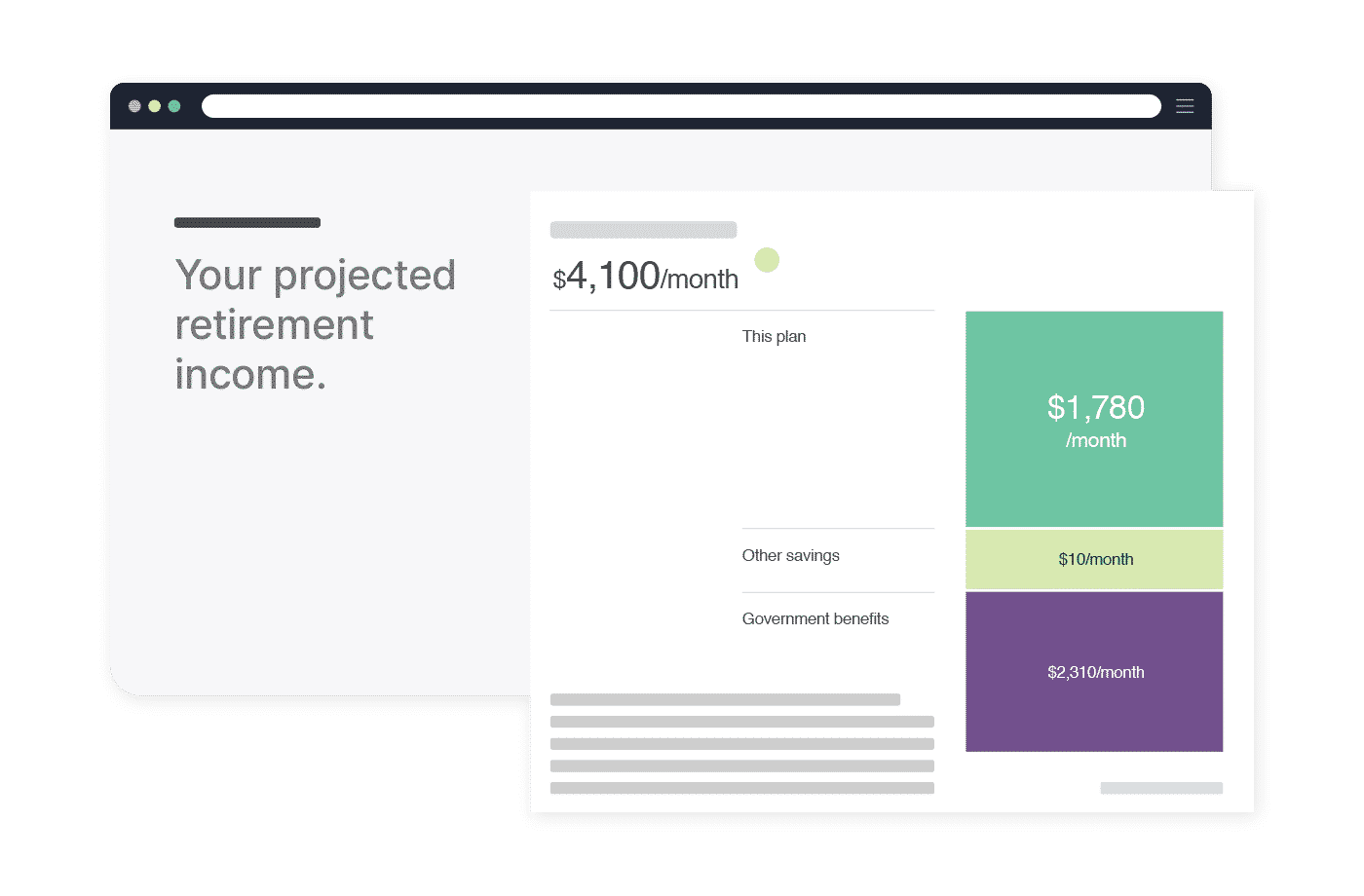

Built-in personalized planning shows how much you’ll need in retirement, how much to expect in government benefits, how much to save, and where to invest.

RETIREMENT CALCULATOR

Retire sooner with lower fees

Use our retirement calculator to find out how much you’ll need to save to achieve your goals and see how lower fees can help you get to retirement faster.

GROUP RETIREMENT ADVISORS

Enhance your clients’ plans and unlock greater recurring revenue potential

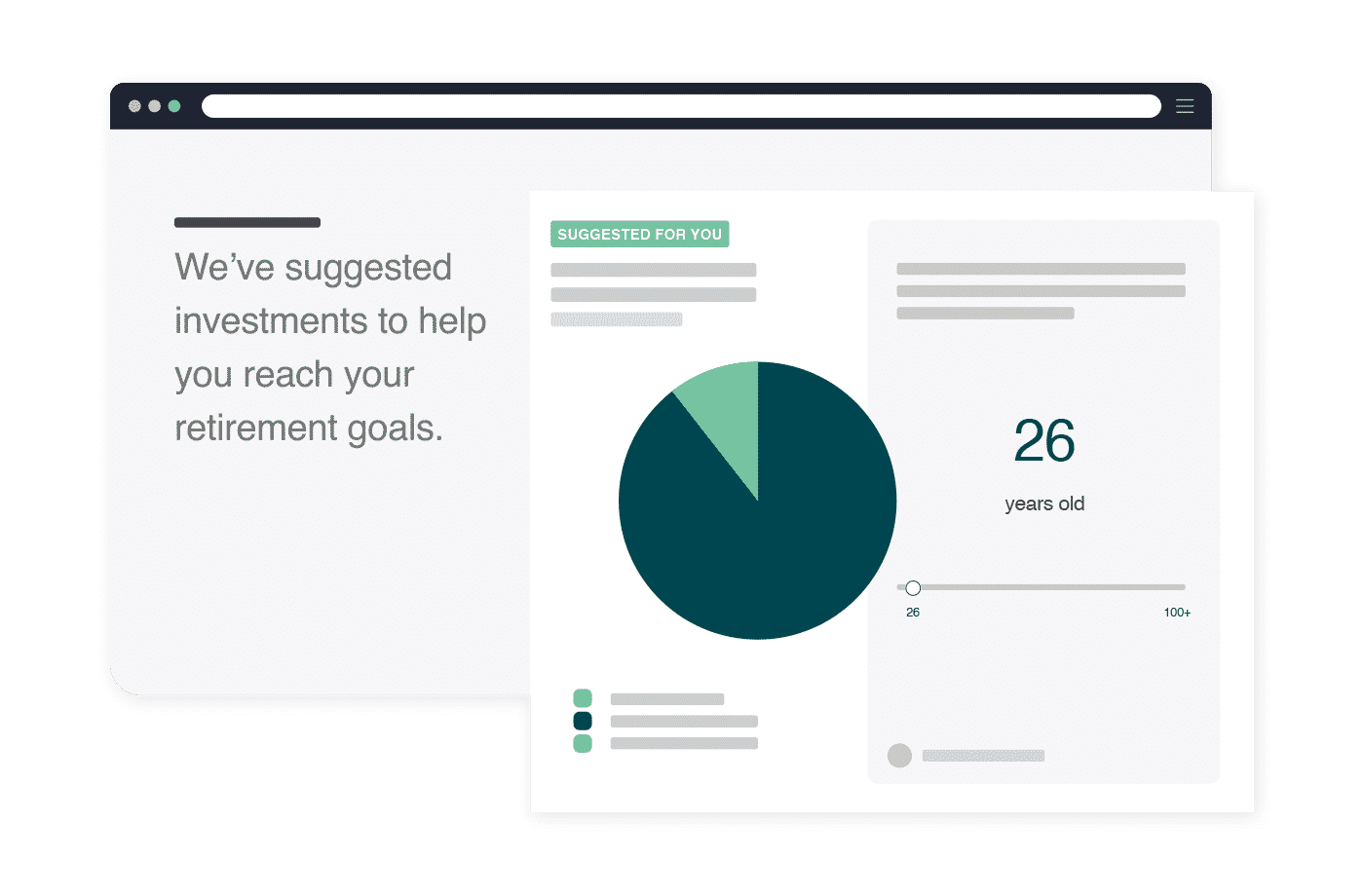

The most innovative retirement platform

Modern technology

More impactful, engaging, and easier to use than legacy providers

Service excellence

Exceptional support for members, employers, and advisors

Streamlined investment approach

Optimizing for retirement with expert financial strategies

Continuous improvements

Always enhancing the user experience based on customer feedback

True retirement plan for life

A benefit your employees will truly value

Give your team a benefit that resonates, engages, and leaves a lasting impact by building a brighter future.