For Advisors

The best way to grow your group retirement business

Join the hundreds of advisors offering unmatched innovation, transparent service, and a digital retirement platform that their clients love!

Our commitment to advisors across Canada

Discover why we are the fastest-growing group retirement provider in Canada

Exceptional Service

Revenue Growth

Excellence & Trust

Award-winning technology & service excellence

2022 Innovation Award in Technology

2023 Retirement Management Innovation

2023 Most Innovative Retirement Company

A partnership built on value creation

Deliver greater value to your clients

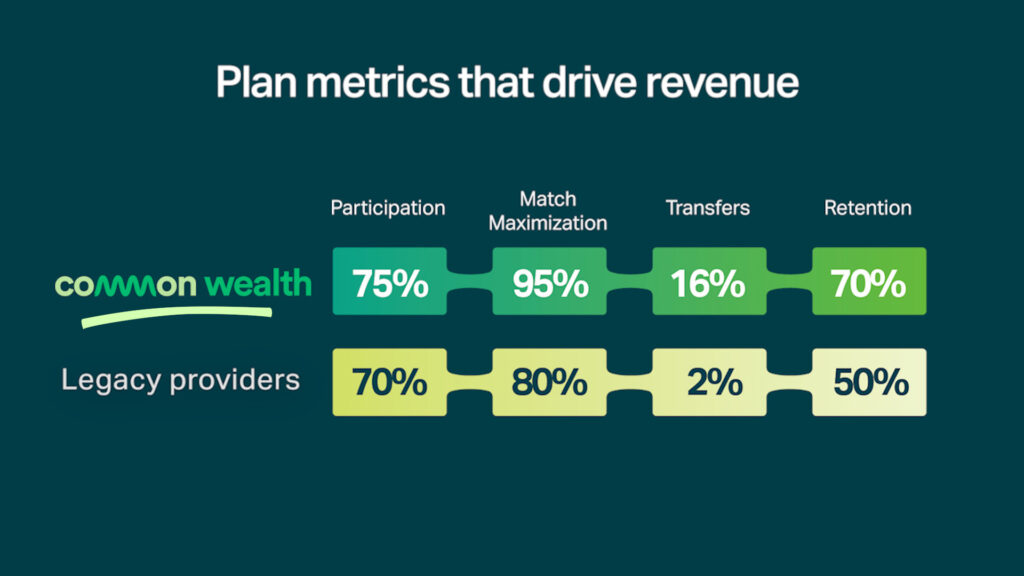

Our award-winning platform sets the standard in the market with its innovation and service, allowing you to stay competitive. Leverage our leading platform to enhance client engagement, optimize match contributions, and facilitate asset transfers, thereby improving client retention and satisfaction.

At Common Wealth, we are dedicated to providing comprehensive and user-friendly group retirement solutions, ensuring you deliver top-tier services and technology to your clients.

Maximize Revenue, Minimize Effort

Common Wealth’s modern retirement platform opens new market opportunities and higher client value with less effort, so you can deepen your relationships with clients while building a compounding revenue stream.

We’ve designed a flexible service model that aims to support your business – everything from preparing proposals to providing member education, reporting and regular plan reviews.

Capturing the GRS revenue opportunity – David Emanuel, Vice President & Head of Workplace Solutions, IDC WIN

Unlock greater value and revenue with Common Wealth – Greg Barill, Dir. of Benefits & Pension, Barill & Company

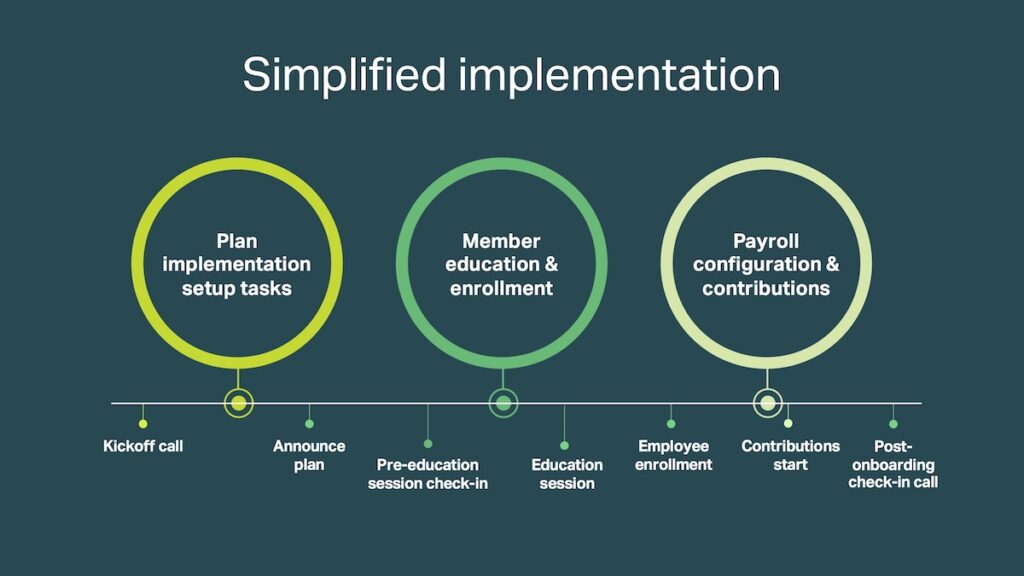

Designed to simplify your operations

Our engineered approach ensures smooth client onboarding, enabling you to concentrate more on client relationships and less on administrative tasks.

When moving clients over to Common Wealth, experience a seamless transition process with minimal effort on your part. Benefit from our team’s extensive expertise in retirement and pensions to provide your clients with dedicated group retirement services.

Connect with the Common Wealth team to develop your custom revenue program and help bring your clients to a modern retirement solution.

“Common Wealth is an offering that promises to revolutionize the group savings space.”

VP of Workplace Solutions

“Common Wealth truly is a game changer, and they are setting the stage for the evolution of the group savings industry.”

Managing Director of Group Savings

“Transferring group plans to Common Wealth couldn’t be easier. The platform is turnkey…”

Partner

“Common Wealth has been groundbreaking for our business. Their modern technology and service model make it significantly easier to add retirement benefits.”

Partner

“I am confident that my clients and the members are well supported by the Common Wealth team. Their client support is definitely top-notch.”

Partner

“It can take up to 6-7 hours to set up a typical group plan with a client. With Common Wealth, it takes under an hour.”

President

“For one of the plans we set up with Common Wealth, we had 98% of the employees enrolled in the first two weeks. I have never had that happen before.”

Senior Group Retirement Consultant

“I believe Common Wealth will be a great tool for me to scale a new group RRSP division for my business with the ability to get this done fast and efficient.”

Financial Advisor

“I can completely trust that if I introduce my clients to the Common Wealth team, they can really represent my firm in the best possible way.”

Director, Benefits & Pension

The Common Wealth Difference

Common Wealth’s digital retirement platform integrates RRSP, TFSA, DPSP, and DC Pension Plan in one plan for easy setup and maintenance.

Low fees for all

Common Wealth is the ideal retirement savings plan for small, medium, and large-sized businesses.

Fully digital setup

Plan setup and maintenance and employee onboarding are quick and easy, thanks to our completely digital experience.

Built-in planning

Members can visualize their retirement income, government benefits, and personalized contribution schedules, crafting a true retirement plan for life.

Streamlined admin

Common Wealth works with a wide range of payroll systems, minimizing administration and freeing your time to focus on managing and growing your business.

Retirement experts

We offer expert support to help your employees make informed retirement planning choices as they move from job to job and into retirement.

Safe and secure

The Common Wealth platform is SOC 2 certified, ensuring your employee data and transactions are encrypted and secure.

An advisor experience

tailored to your needs

Our Common Wealth Advisor platform provides real-time insights into your group retirement business, as well as sales and marketing resources.