For MEMBERS

The best way to manage your retirement savings

Common Wealth’s modern platform provides you with a lifetime of retirement planning tools and expert support whenever you need it.

Our commitment to members across Canada

What you can expect from the country’s fastest-growing group retirement provider

Low fees for life

Service excellence

True retirement plan for life

Efficient enrollment

Award-winning experience

Enjoy our our easy-to-use platform and manage it online.

Award-winning technology & service excellence

2022 Innovation Award in Technology

2023 Retirement Management Innovation

2023 Most Innovative Retirement Company

How It Works

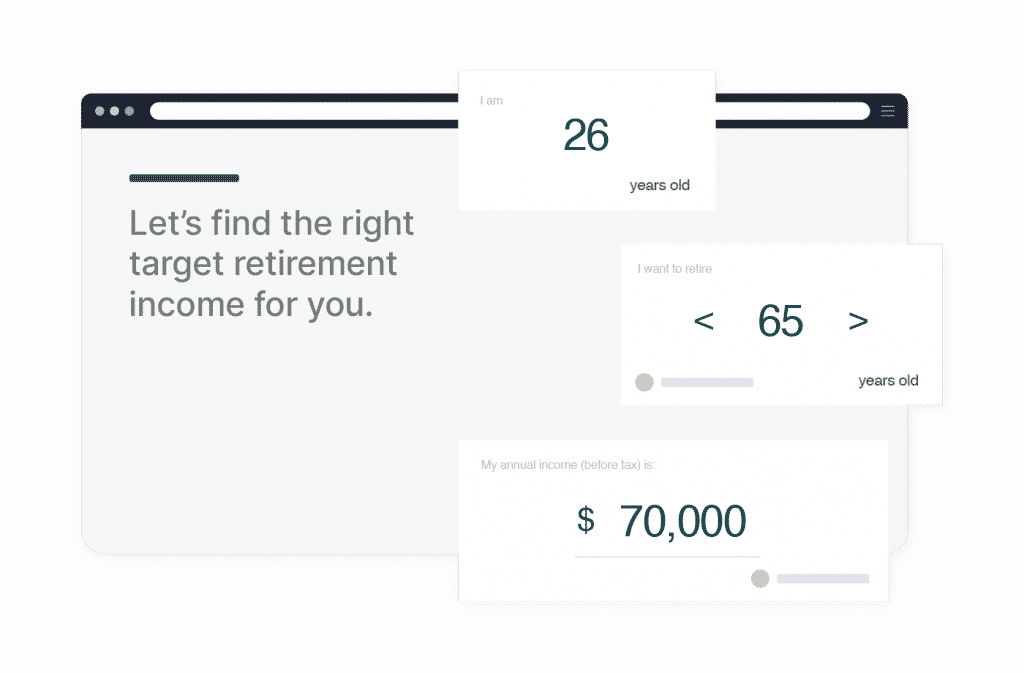

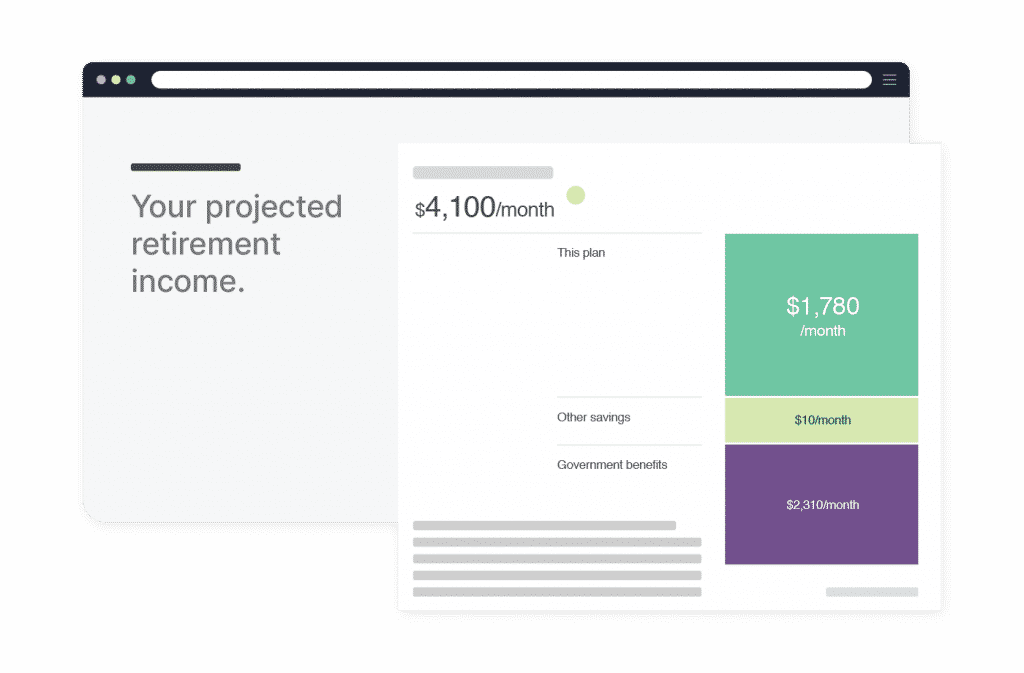

Plan

We’ll help you figure out how much money you need in retirement and how much to save to get there

- Your plan will estimate how much you’ll need in retirement, how much to expect from government benefits, and how much to save

- Your plan automatically adjusts your suggested monthly saving amount as you make contributions and transfer in funds

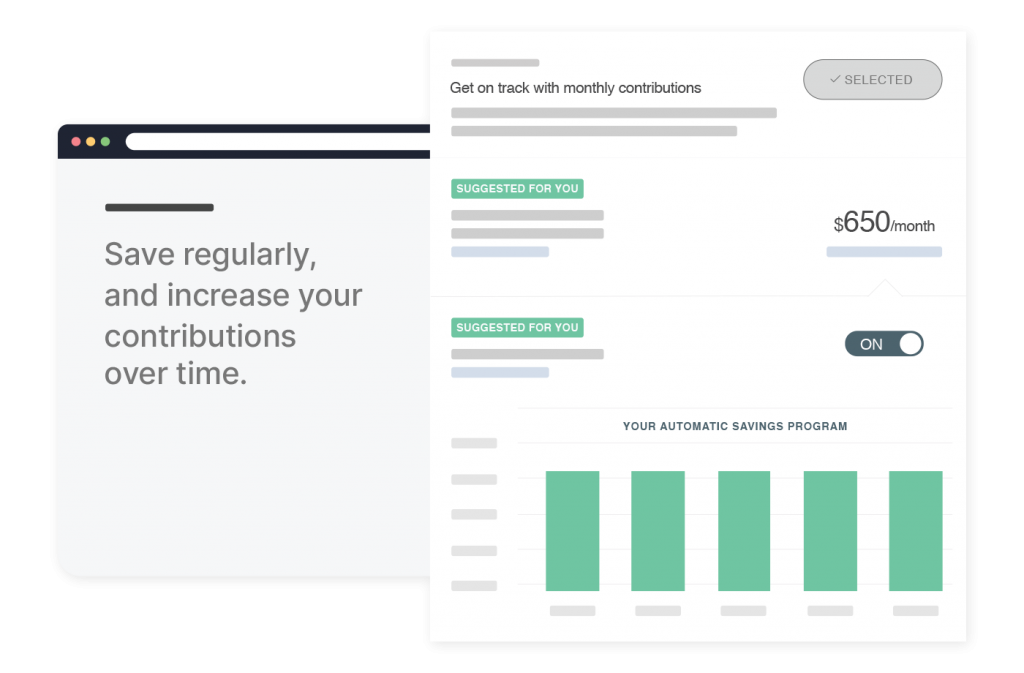

Save

Automatic saving helps you stay on track to meet your retirement goals

- Make monthly contributions right from your paycheque and connect to your bank account to add more funds

- Save to an RRSP, TFSA or both

- View your contributions and any employer matching contributions

- Transfer an existing RRSP, TFSA, or LIRA into your plan in a few clicks

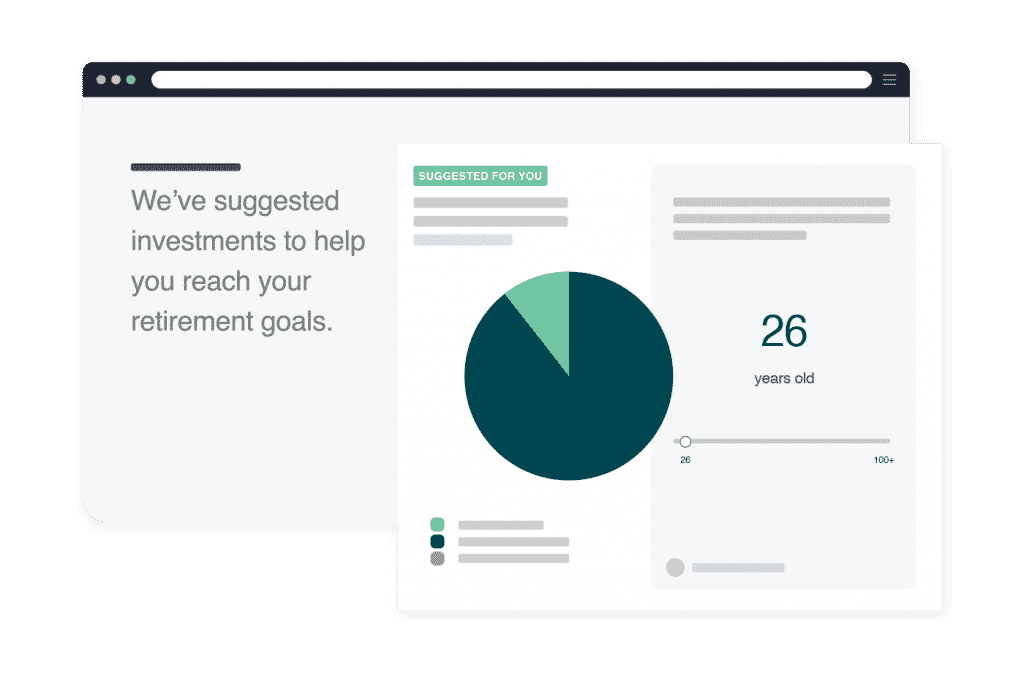

Invest

Our smart investing approach matches you to the risk-appropriate investment fund for your life stage

Your plan invests your savings into a professionally managed, diversified target date fund that automatically rebalances and adjusts your risk over time – so you can set it and forget it, while the plan works to build your retirement savings.

The Build My Own Portfolio feature, which allows members to allocate assets in line with their investment risk, is available in select group plans.

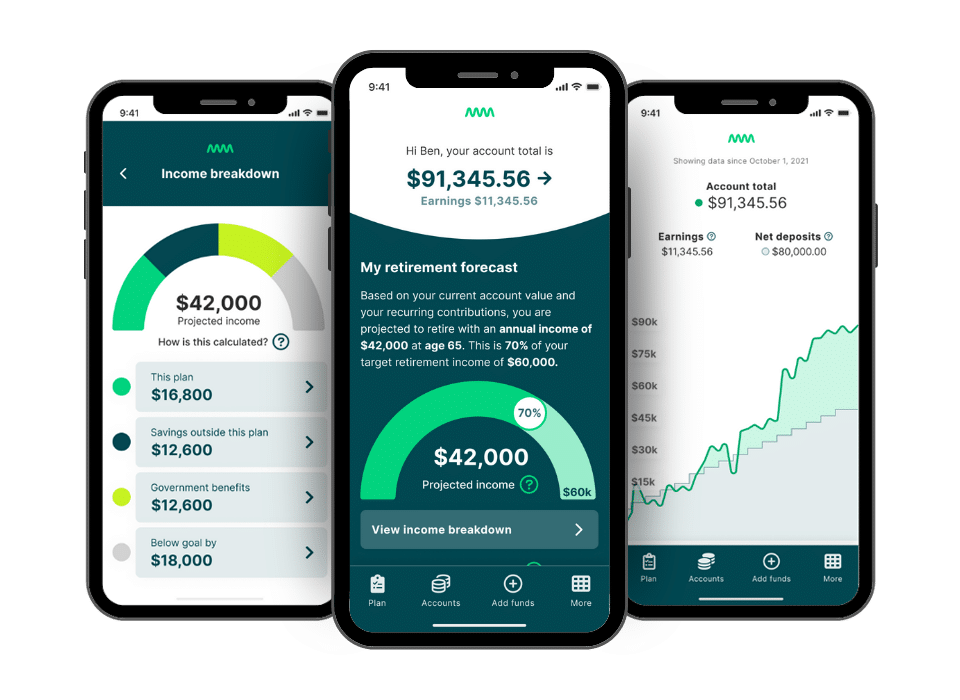

Track

Our digital plan makes it easy to track your progress online

You’re in full control—you can change and pause contributions or withdraw your savings whenever you choose

Director of People Operations

“What I love about Common Wealth is the customer service… just great people behind a really great platform.”

Operations Manager

Country Director, Canada

Senior Group Retirement Consultant

“I would say that Common Wealth’s technology is unparalleled in the marketplace. Most importantly, it’s very user-friendly.”

Partner

“I think Common Wealth has focused so much on the member experience to make it really smooth and easy and clear.”

Director, Benefits & Pension

Access our Canadian team of retirement specialists for a personalized review to maximize your plan benefits, including:

- Consolidating your other savings accounts

- Keeping your plan after moving on from your employer

- Transitioning into retirement

Access your plan

anywhere, anytime

Get your plan on your Android or iOS device

- View your balance and investment earnings

- Check your RRSP/TFSA/DPSP/DCPP contributions

- Add funds or transfer in any existing RRSP, TFSA, RRIF or LIRA

- Track your retirement readiness and expected retirement income

Log in to your plan from your mobile browser and follow the prompts to add the app to your phone.

The Common Wealth Difference

Common Wealth’s digital retirement platform integrates RRSP, TFSA, DPSP, and DC Pension Plan in one plan for a holistic view of your retirement savings.

Low fees for all

Common Wealth helps Canadians of all income levels achieve their retirement goals.

Modern platform

Plan enrollment is quick and easy, and members can transfer in existing savings in a few clicks.

Built-in planning

With built-in planning tools, we’ll help you save on taxes and maximize your government benefits.

Payroll deductions

Make automatic contributions from your paycheque, as well as your bank account.

Retirement experts

We offer expert support to help you make informed retirement planning choices throughout your career.

Safe and secure

The Common Wealth platform is SOC 2 certified, ensuring your data and transactions are encrypted and secure.

Enrolling in your retirement plan is easier than you think

Set up a 30-minute virtual meeting with a retirement specialist, who can walk you through the enrollment process.