MODERN RETIREMENT PLAN

The easiest way for QuickBooks users to offer retirement benefits

Common Wealth is a modern workplace retirement plan that lets employees save to an RRSP right from their pay

Connect with a retirement benefits specialist to explore a plan for your team.

The only group RRSP that integrates with QuickBooks Canada

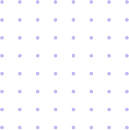

An easy way to give employees the benefits they really want.

Attract and retain employees with a modern workplace retirement plan

- Smart investing: Common Wealth invests RRSP savings in a professionally managed fund from BlackRock. This gives employees a proven strategy to maximize their savings, without employers needing to manage investment selection.

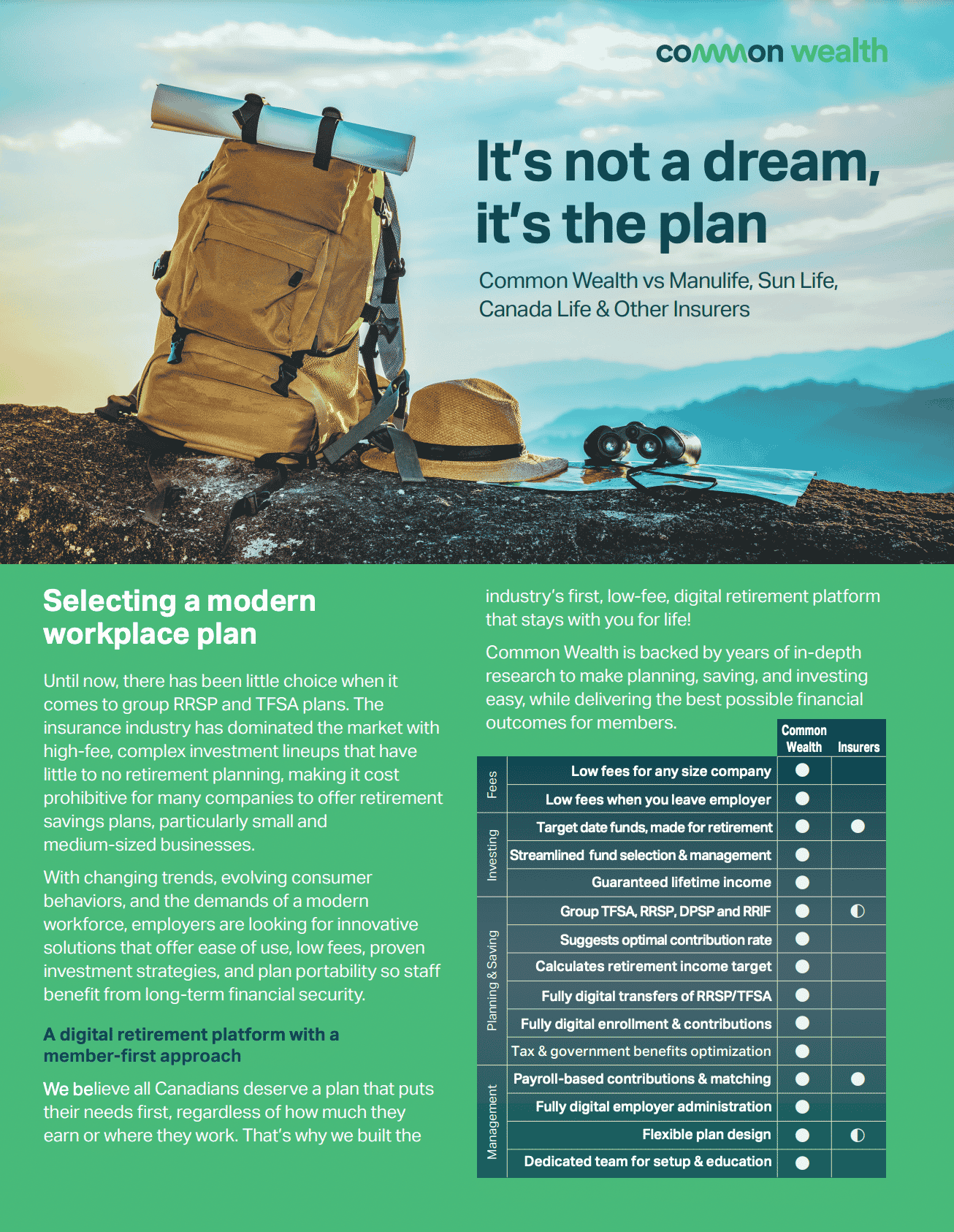

- Personalized planning: Common Wealth helps you figure out how much money you’ll need in retirement, how much to expect from government benefits, and how much to save to meet your retirement goals.

- A plan for life: When employees retire or move on from your company, they maintain access to a low-fee plan, so they can continue to contribute or manage their retirement investments.

80% of people are more inclined to work [and stay] with a company that offers matching contributions to their retirement savings plan.

Natixis Investment Managers, September 2021

Easy plan setup

You’ll get a dedicated Common Wealth retirement specialist, guided setup and employee onboarding, and a virtual employee education session to ensure you and your team get the most out of your plan.

Contact Common Wealth to get an estimate for a retirement savings plan for your team!

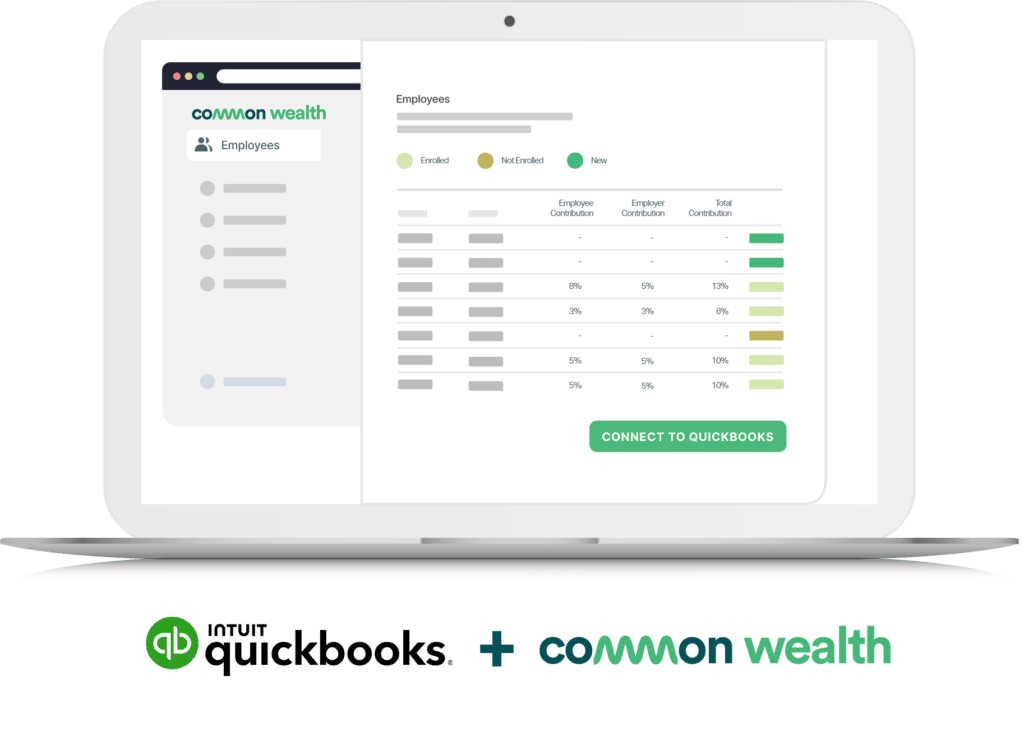

How we work with QuickBooks Payroll

Fully automated plan maintenance

Common Wealth seamlessly integrates with your QuickBooks Payroll to automate all plan maintenance, saving you time every payroll cycle compared to plans that require manual data entry and paper-based processes.

- Automatically adds & removes employees based on their payroll status

- Updates your payroll when employees change their contribution amounts

- Deducts and invests contributions every payroll cycle

- Securely connects and syncs data between systems

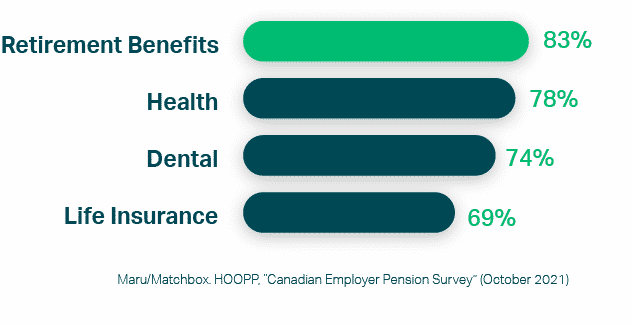

The Common Wealth Difference

Common Wealth has created an innovative digital platform that delivers world-class investing, digital administration and member planning features not available in other workplace plans.

Rapid setup & enrollment

Common Wealth will set up your group RRSP, invite employees to enroll, and educate your team.

Automatic deductions

Syncs with QuickBooks Payroll for hands-free administration of your payroll contributions.

Streamlined user management

Automatically detects new hires, inactive employees and terminated staff to ensure accurate deductions.

Automatic changes

Any changes employees make to their contribution amounts are automatically applied and reflected in your QuickBooks payroll.

Reports & tax receipts

Common Wealth handles all recordkeeping, investment reporting and member tax receipts.

Secure, bi-directional sync

Common Wealth securely syncs data daily, for a real-time view of employee contribution amounts in both platforms.

Retirement offerings are provided and administered by Common Wealth, an independent third party and not provided by QuickBooks. QuickBooks is not a retirement plan administrator, fiduciary, or retirement plan provider.

Let's talk

Connect with one of our retirement specialists to find out how a group RRSP can benefit your team.