The need for workplace financial wellness

Work culture has changed. Hybrid work-from-home models and greater financial stress have created an unsettled workforce and a competitive labour market. This has many employers looking for workplace financial wellness programs that will help attract and retain top talent.

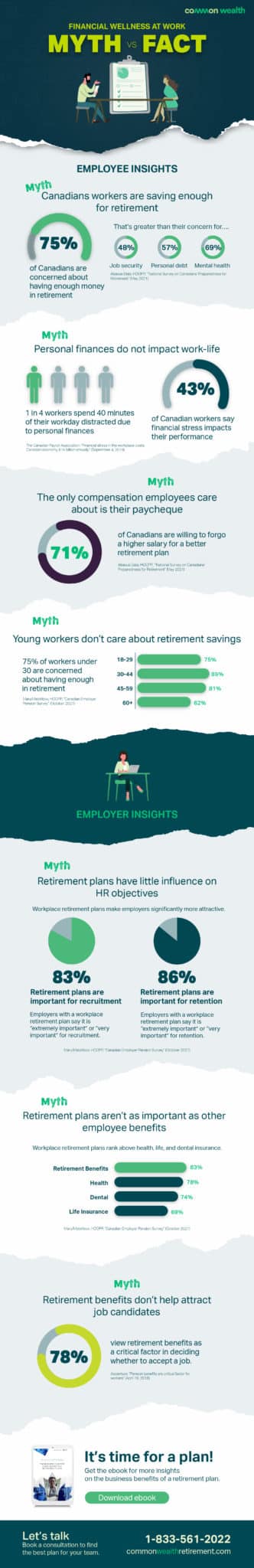

A new HOOPP commissioned report by Common Wealth shows that financial wellness is top of mind for Canadian workers. Explore the myths and facts of retirement and how a good group retirement plan can help you meet your HR objectives, while complementing your existing employee benefits.