The Benefits Of A Workplace Retirement Plan

One of the reasons employers want to introduce a retirement plan is a desire to kick-start the savings process for their team. Making sure first-time savers see retirement benefits as a compensation boost, not a take-away can be daunting. One way employers can position their new retirement plan in the most positive light with their staff is by explaining the magic of compounding investment returns.

Almost everyone, including seasoned investors and math whizzes, underestimates the value of compounding. Behavioural scientists talk about the related concept of “present bias” – the human tendency to systematically value present rewards more highly than future ones.

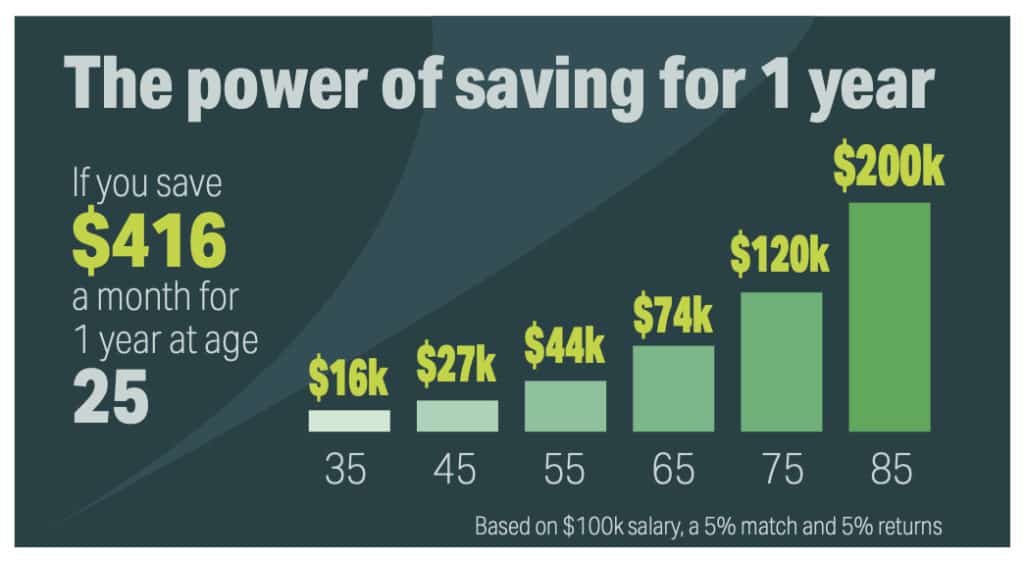

We can compensate for these blind spots by emphasizing the value of compounding – and how it grows your savings over time. Sharing a concrete example (as shown in the chart below) is often better. The right kind of education can help overcome our innate biases – and set your employees up for long-term financial success.

Growing Your Savings Over Time

Let’s check out the example of an employee with no existing savings and a $100,000 salary. In scenario 1, that employee “pays” (reduces take-home pay) by $2,952 in exchange for $10,000 of retirement savings. But the real benefit isn’t the $10,000 of savings. It’s what those savings turn into later after years of compounding investment returns.

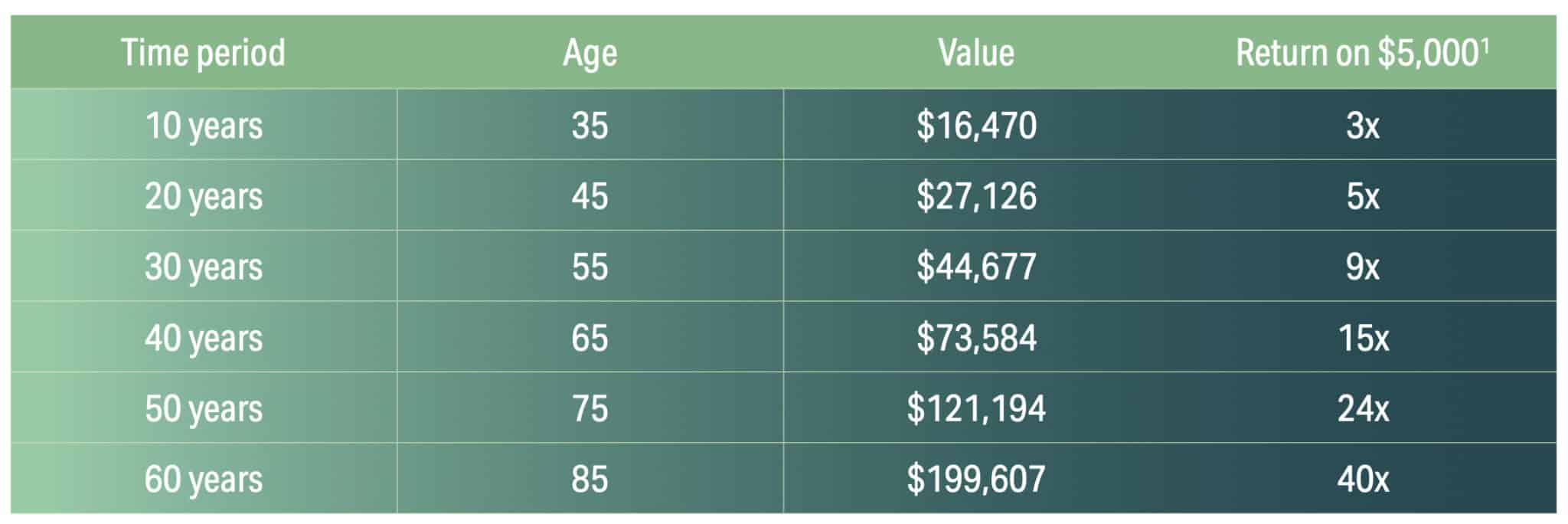

Let’s say the employee is 25 years old. Here is how that initial contribution of $10,000 ($5,000 of which is paid by the employee) could grow over time, assuming a 5% net annual return.3

In other words, you could say to employees, “The $5,000 you save today (which actually costs you less than $3,000), when matched by us, could turn into up to $200,000 (40x your initial investment and double your current salary) by the time you need it.” That’s a powerful message and a pretty great return on investment!

It’s important to remember that the compounding period for saving isn’t just up until retirement; it’s also the period post-retirement, which can be 30 years or more. As the chart illustrates, this is when the true benefits of compounding really kick in. So remember to show employees not just how their money could grow over the next 10 or 20 years, but over the next 50 or 60 years.

1 Because the retirement income you eventually derive from RRSPs (through a vehicle called a Registered Retirement Income Fund or RRIF) is subject

to income tax, to make an apples-to-apples comparison we talk about the $5,000 employee contribution here, even though the actual after-tax cost of the employee contribution is $2,952.

2 Calculated using Intuit’s TurboTax Canada income tax calculator. Assumes Ontario provincial tax rates and no other source of income.

3 Compound interest calculators provided by the Ontario Securities Commission’s getsmarteraboutmoney.ca.

—

More resources

Learn about other ways to get your employees to love their retirement benefits by downloading our free guide on attracting and retaining talent with a group retirement plan.