By now, most experts agree that Canada is headed for an economic cooldown in 2023, but it’s likely to be short-lived – and it probably won’t take the heat off the ongoing talent shortage.

When times get lean, businesses depend on a skilled and engaged workforce to help them stay resilient. But, as new reports show, higher inflation is driving up employee financial stress – draining productivity and ramping up flight risk.

At a time when businesses need to minimize disruption and find ways to trim back operating costs, one budget line item stands out as a natural opportunity for savings: the high cost of employee churn.

But what’s the best way for employers to convince their best talent to say – without breaking the bank?

Employee turnover costs businesses big

According to a survey from Express Employment Professionals, more than one-third of Canadian companies (35%) say employee turnover has increased compared to last year, a significant rise from the 24% who said the same thing in 2021.

When employees leave, the company takes a hit with direct expenses like paying out accrued vacation time and recruitment costs. But there are also indirect costs, like the loss of institutional knowledge and slowed productivity from a smaller team.

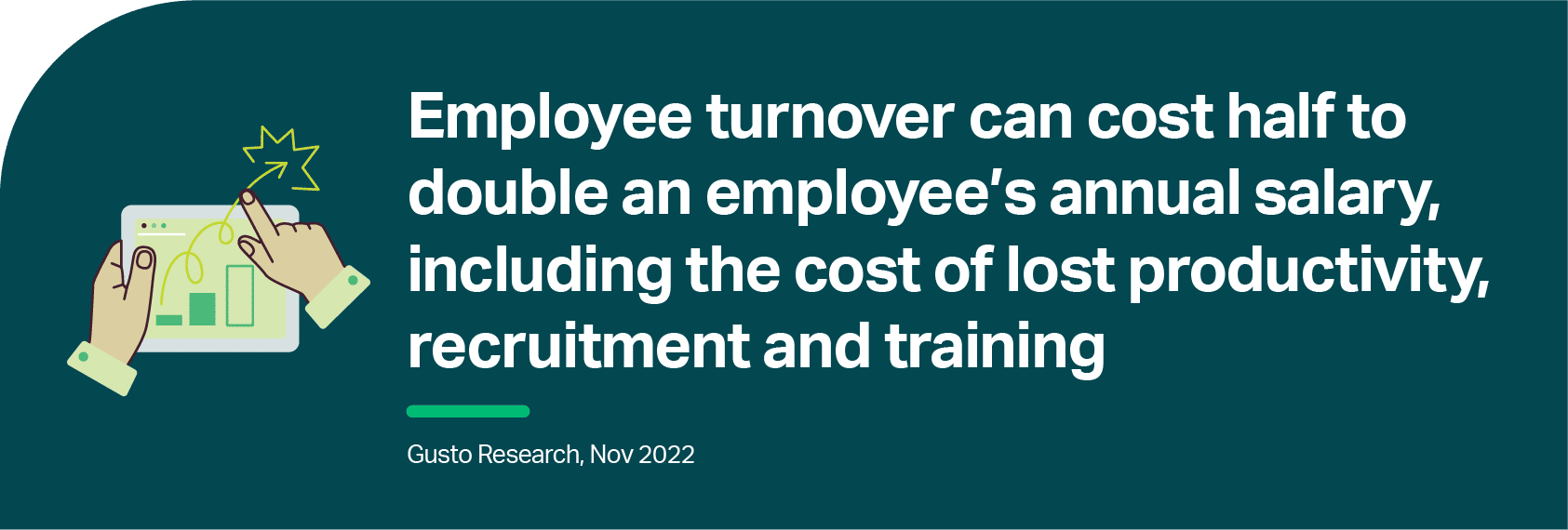

A new report from Gusto suggests the cost to lose an employee can be anywhere between half and twice the amount of an employee’s annual salary. That means for a company with 20 employees making $95,000 per year, losing 3 employees could cost the company between $142,500-$570,000 to recruit, train, and get back up to previous levels of productivity.

… And many employees are looking for greener pastures

The percentage of working Canadians looking to make a move has jumped to 50% from only 31% in June 2022, according to Robert Half.

This may not be a complete shock, considering that employee financial stress is at its highest recorded point since the 2008 financial crisis. A Ceridian survey found that six in ten (61%) employees say they’re stressed about their finances, and most (82%) say they spend time at work thinking about their financial situation. In Canada, this adds up to $50B in lost productivity.

Retirement benefits can help businesses stay resilient

Creating strong reasons for employees to stay is critical in 2023. A happy work culture, competitive pay and great retirement benefits are key.

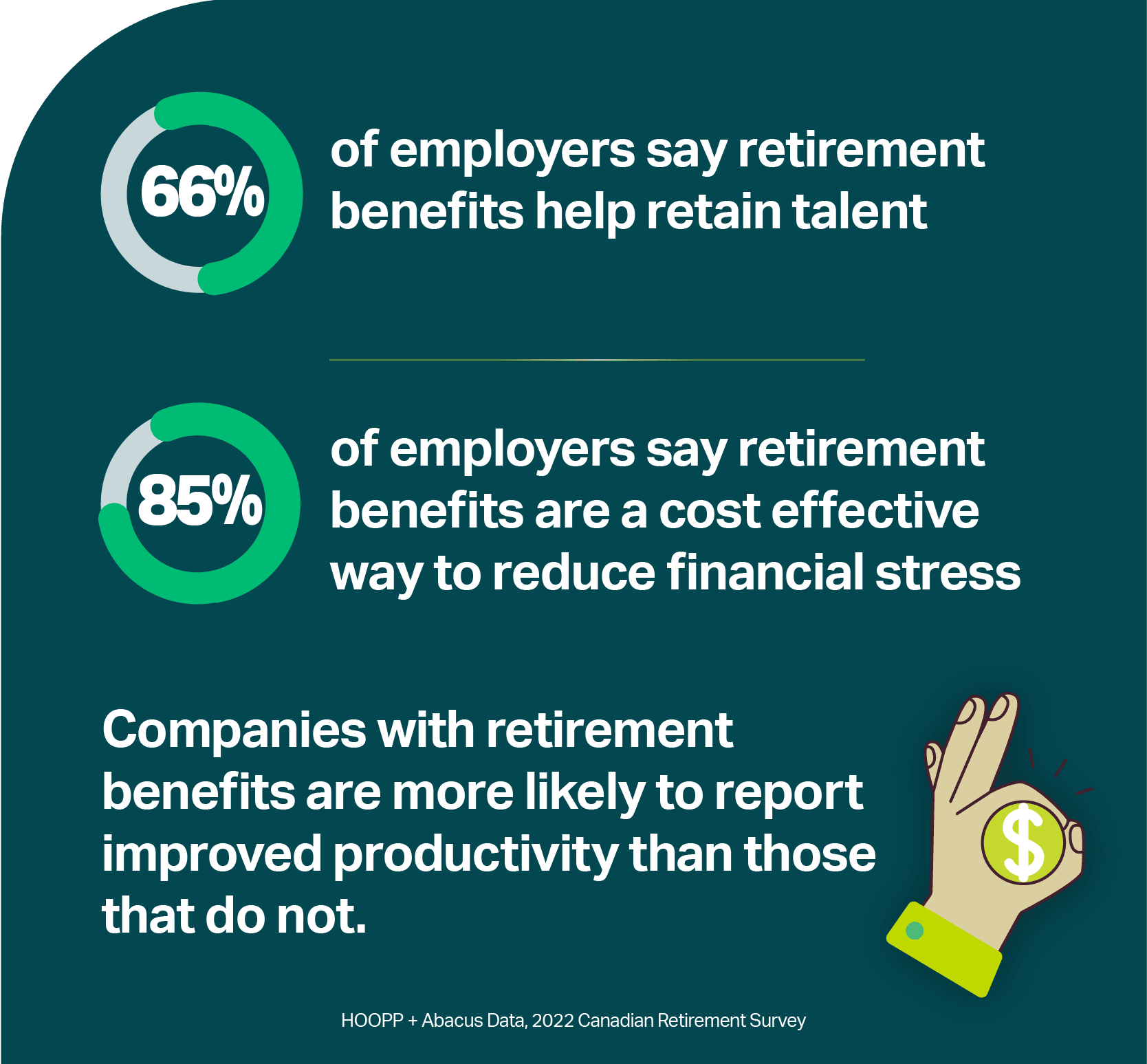

According to a recent HOOPP and Angus Reid Group report, the majority of employers say that retirement benefits are a cost-effective way to reduce financial stress, boost productivity and encourage staff to stay long-term.

The Gusto report goes on to say that an employee with a retirement plan has a 40% lower chance of quitting by the end of their first year and with an estimated annual cost savings of more than $100,000 for small and medium sized businesses.

If you have a retirement plan with low fees, world-class investment management and an easy digital experience, you’re well on your way to helping employees get the best value for their savings. To encourage even greater retention, you can also consider increasing your employer match based on tenure.

To learn more about setting your matching options, or to set up a workplace retirement plan that will help your business stay the course, talk with your advisor or book a consult with our team.