What happens to group retirement plans after employees leave?

In choosing or managing a workplace retirement plan, one question that employers should be asking is what happens to employees after they leave or retire.

For most Group RRSPs and TFSAs provided by big insurers and banks in Canada, the answer is former employees get moved into an individual product with higher fees, greater complexity, and less consumer financial protection.

It is not uncommon for big insurers and banks to double or triple the fees people pay when they leave their employer’s group plan. If you’re lucky to work for an employer whose size allows it to negotiate lower fees with an insurer or bank, the increase can be even higher after you leave.

This actually happened to me. One of my former employers offered a Group RRSP. After I left the employer, I just left my money in the plan. I had no idea that my fees were going up. Maybe the fees were disclosed in some fine print somewhere. I didn’t see them. Eventually I moved the money out of that plan to do a downpayment on a home, but if not for that, I might have left it in that account for years, having my investment returns being eaten away by fees that I mistakenly thought were low because it was a group plan being provided by a fairly large employer.

I often think: if I was unaware of these fee increases, after having spent years working on retirement policy and regulation, after having advised some of the most successful pension funds in the world, how is the average Canadian supposed to navigate a situation like this?

The Cost of Breaking Up

Out of curiosity, our team dug into this issue to see if any publicly available information on these fees was available from any of the three large insurers who dominate the Canadian market. We weren’t able to find anything.

Here’s an example of a brochure from Sun Life’s “Group Choices” program for former employees. It talks about the importance of fees, rightly pointing out that high fees can cost you big time. But it does not say what the fees are for Group Choices.

Manulife’s brochure for its personal plans for ex-employees states that “you’ll continue to take advantage of the purchasing power of a group retirement plan.” That brochure doesn’t say what the fees are either. When one of my colleagues, who recently left a very large employer to join us, showed me his Manulife statement for his rolled-over account, the fees for most funds were around 2% or even higher — in line with Canada’s highest-in-the-world fees for retail investments.

Why do big banks and insurers do this? Because they can. Fees for group plans, especially for savvier and/or larger employers, are slowly being compressed, and legacy providers are trying to make up those profits by charging higher fees on ex-employees and retirees — or “rollovers” as the industry often calls them. And governments do little to protect consumers in these situations.

Thankfully, some employers are starting to wake up to this practice. They are starting to ask providers what will happen to their employees after they leave, and some are choosing not to work with providers that double or triple fees on former employees because it severely undermines that value of the workplace benefit they are providing.

How Fee Structures Impact Your Savings

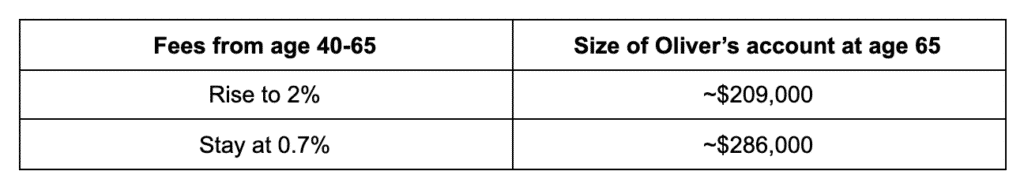

Here’s an example. You have an employee, Oliver, who works for you for a decade, from age 30 to 40. During that time, he builds us $100,000 in savings in the company’s Group RRSP, a mix of your contributions and a healthy company match. As an employer, you’ve done a nice job helping Oliver get started with retirement saving, and he’s earned higher net returns as a result of the lower fees that you’ve been able to negotiate as an employer — let’s say these are 0.7%. But after Oliver leaves your plan, his fees increase to 2%.

Below I did some quick math using Larry Bates’s “T-Rex Calculator” — a great tool for understanding the impact of fees — using a starting balance of $100,000 at age 40, and assuming a 5% annual investment return before fees.

The rise of fees in the “roll-over” plan will have cost Oliver $77,000 that he could otherwise have had for his retirement. This doesn’t even include the effect of fees in the post-retirement phase, which can be even more material because that is the phase when your assets are often highest.

HR leaders, and the organizations they serve, are often evaluated by the way they treat employees on the way out, whether that means voluntary departures, involuntary departures, or retirements. Former employees can be a valuable source of new business and new talent for the company. One way to treat them better is to ensure the retirement plan you are investing in will continue to be high-quality after the employee leaves.

The fee increases on former employees are also starting to attract scrutiny from the legal community and from regulators. Some employers, as retirement plan sponsors, are concerned about the legal and regulatory risk of offering a plan that doubles or triples the fees when an employee leaves.

How To Protect Yourself

To protect yourself and your employees against this scenario, don’t be afraid to ask providers what will happen to retirement plan members on the way out:

- What happens to plan fees?

- What kind of service will former employees and retirees receive, including during the transition period?

- What changes occur in the legal protections afforded to plan members?

- How will you communicate with plan members who leave? How will members understand what their options are?

Work has changed. Very few people stay at a single employer for their entire lives. We need truly portable retirement plans that continue to treat you well after you leave your employer.

At Common Wealth Retirement, when you leave your employer, you are automatically transitioned into one of our individual plans. Like our employer-based plans, and unlike the big insurers and banks, these plans offer transparent pricing and low fees, so that both the employer and the employee knows what will happen when the employment relationship ends. We hope others in the industry will follow suit. But given how much money the legacy providers are making on rollovers, we’re not holding our breath.

Written by Alex Mazer, Founding Partner at Common Wealth Retirement