For Employers

The best way to attract and retain talent

Give your team the most valued workplace retirement plan on the market.

Our commitment to employers across Canada

What you can expect from the country’s fastest-growing group retirement provider

Low fees for life

Service excellence

True retirement plan for life

Efficient adminstration

Easy to manage your plan every pay cycle

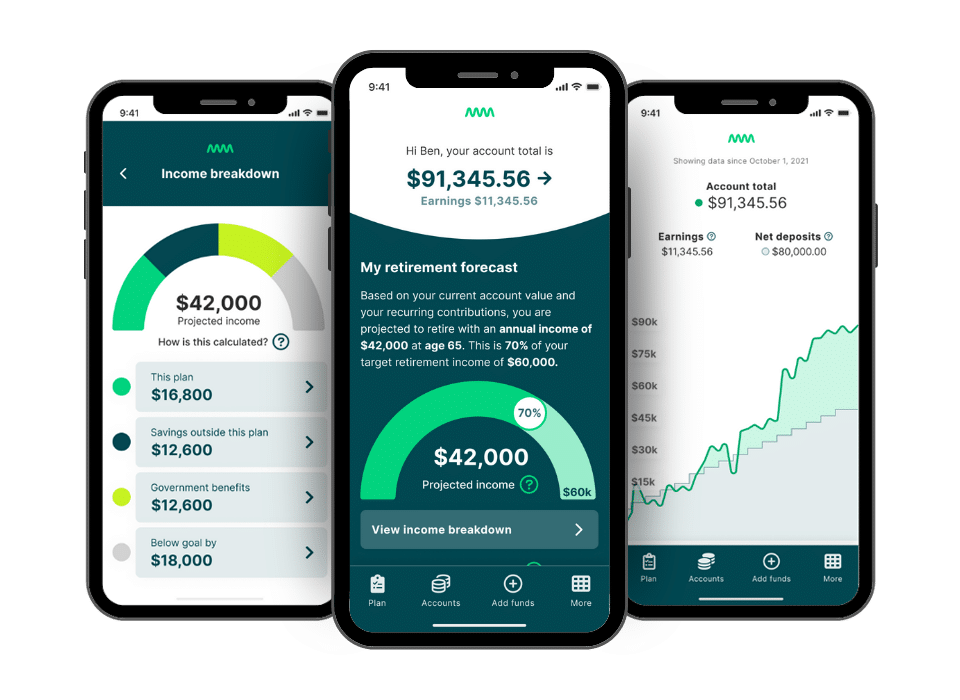

Award-winning experience

Award-winning technology & service excellence

2022 Innovation Award in Technology

2023 Retirement Management Innovation

2023 Most Innovative Retirement Company

A modern group retirement plan

for today’s workforce

Common Wealth plans are designed to work for any size company, with a quick and easy way to set up and manage your plan.

- No investment knowledge required

- Fully digital employee enrollment

- Flexible contribution and matching

- Flexible plan design – RRSP, TFSA, RRIF, DPSP, DCPP

- Automatic payroll deductions

- Employer dashboard to manage your members

Helping union members in British Columbia, in partnership with HUB

RRSP Employer Match

Reaching new heights by upgrading their RRSP plan, in partnership with Bridgewell

RRSP Employer Match

Daycare staff are now able to plan a bright financial future, in partnership with Elementus Wealth

DPSP Employer Match

A top employee perk that's easy to manage, in partnership with Peak Benefit

DPSP Employer Match

Netting a greater return with competitive benefits

RRSP Employer Match

Providing employees with a financial safety net in retirement, in partnership with HUB

DPSP Employer Match

Moving plans for a more retirement-focused digital platform, in partnership with Sterling Capital

RRSP Employer Match

Replicating retirement benefits for Canadian employees, in partnership with Acera

RRSP Employer Match

Making a splash with a modern group RRSP, in partnership with Claremont Benefits

RRSP Employer Match

Staying competitive in the tech job market with retirement benefits

RRSP Employer Match

Leading the industry with retirement benefits, in partnership with Acera

RRSP Employer Match

Hatching a true retirement plan for staff, in partnership with Acera

RRSP Employer Match

A profit-sharing plan to solidify employees' financial future, in partnership with SPM Financial

DPSP Employer Match

Ensuring all employees have retirement benefits

RRSP Employer Match

Shining a light on the group RRSP to recruit and retain talent, in partnership with HUB

RRSP Employer Match

“What I love about Common Wealth is the customer service… just great people behind a really great platform.”

“Common Wealth was heads and shoulders above the other providers that we were speaking with.”

Access an experienced team of retirement specialists based in Canada, who can help you manage your plan, including:

- Support with the Employer Dashboard

- First payroll run and contributions

- Taxes and annual reporting

The Common Wealth Difference

Common Wealth’s digital retirement platform integrates RRSP, TFSA, DPSP, and DC Pension Plan in one plan for easy setup and maintenance.

Low fees for all

Common Wealth is the ideal retirement savings plan for small, medium, and large-sized businesses.

Fully digital setup

Plan setup and maintenance and employee onboarding are quick and easy, thanks to our completely digital experience.

Flexible plan design

We’ll help you structure a flexible contribution and matching plan that works for your company culture and your budget.

Streamlined admin

Common Wealth works with a wide range of payroll systems, minimizing administration and freeing your time to focus on managing and growing your business.

Retirement experts

We offer expert support to help your employees make informed retirement planning choices throughout their career and into retirement.

Safe and secure

The Common Wealth platform is SOC2 certified, ensuring your employee data and transactions are encrypted and secure.