In 2016 Anxiety Canada wrote about the importance of financial wellness, citing research that stated 47% of Canadians felt the workplace was their largest share of daily stress with the leading factor being workload. While the need to get work done can sometimes be stressful, prolonged pressure can have significant consequences. Mind Beacon estimates that for every 100 employees, there is an employer cost of $181,350 for loss of productivity due to presenteeism, the cost of working while under stress or illness. There are also issues outside of the office, such as family and financial challenges. A 2018 CPA Canada Study stated that 47% of Canadian households were not prepared for a financial crisis, and Statistics Canada reported that the average Canadian household savings was only $852.

A Stress Hat Trick

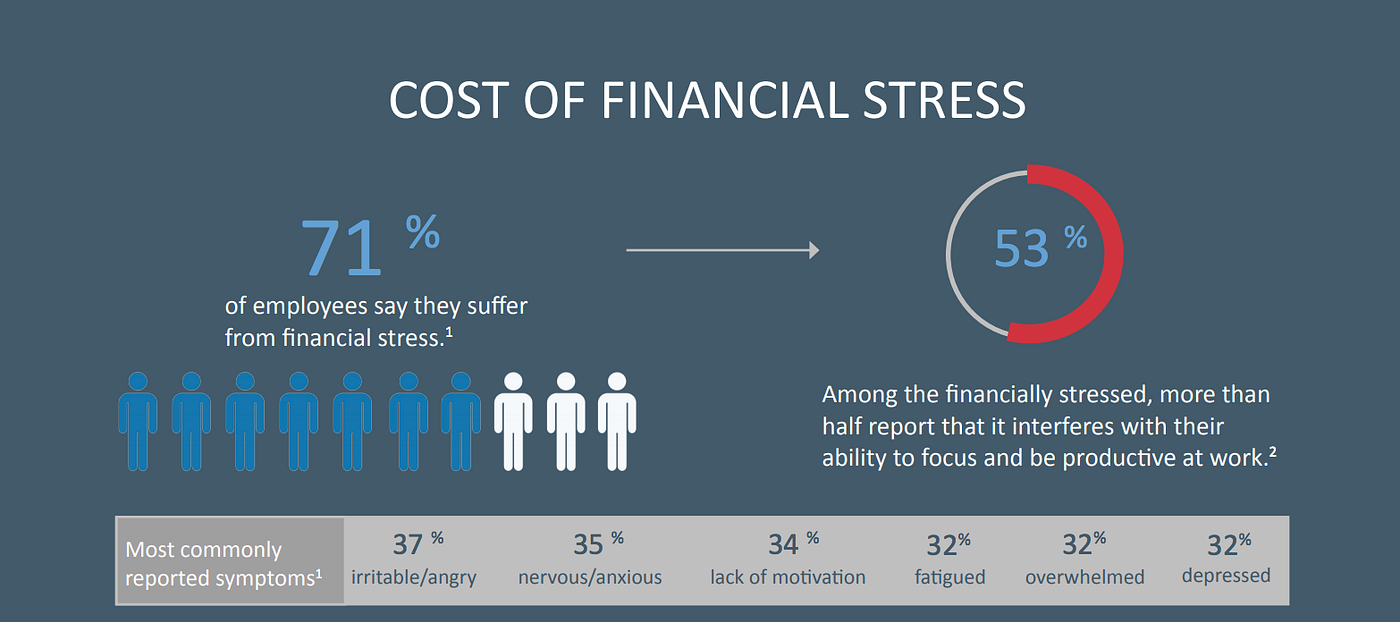

COVID has created a new work-from-home reality that has blended personal, workplace, and environmental stress factors. The resulting economic slump has highlighted the painful reality of how ill-prepared most of us are in the face of a financial downturn and how financial stress impacts job performance. Understandably, this has HR leaders scrambling to find ways of fostering a connection with their employees to improve their overall wellbeing.

Improving Employee Financial Health

The need to promote employee wellness has never been more complex or so needed. It’s not always easy to know where employers should get started, but the evidence is fairly clear. The number one cause of stress and anxiety, according to the 2020 FP Canada 2020 Stress Index, is money, and perceived or real financial risk has a significant impact on our well-being. Having personal savings to fall back on is extremely helpful in times of financial uncertainty.

The Key To Improving Employee Wellness

The work-from-home model has reduced the value of traditional employee perks. In fact, many HR teams are considering reallocating rent, unused social funds, and other untapped office budgets to programs that promote employee financial fitness.

Financial Wellness

Canadians who are fortunate enough to have a pension or group retirement plan have a significant wellness advantage over the majority of the workforce, who go without. Anxiety is often linked to a feeling of being lost or lacking control. A good retirement plan encourages a sense of excitement about the future and can make the discipline of saving money rather effortless. Watching your retirement account grow is fun! Even small savings habits add up and contribute towards solving the symptoms created by financial stress. While having something in place is better than no plan at all, not all retirement plan providers are well suited to support a modern workplace. So how do employers evaluate a plan and what helps employees create financial wellness?

Easy Retirement Planning

Most plan providers — insurance companies, banks and robo-advisors — offer little in the way of actual retirement planning. A plan should help employees answer questions like: How much should I save? How much do I need to live on each month when I retire? How do I turn savings into a retirement income when I retire? What is the best fund to select based on my age?

Simplified Investment Choice

Most people find financial topics complex. Employees generally don’t have the knowledge or capacity to evaluate, adjust, and rebalance their portfolio, or to choose among dozens, if not hundreds, of different funds. To give employees financial confidence, select a retirement plan that uses smart defaults and simplifies the choices employees need to make.

Trusted Partner

Let’s face it, you don’t want to talk to a commissioned salesperson when deciding on where to put your life savings. Support employees with a plan that puts their interests first and gives them access to a world-leading investment manager.

Low Fees Mean More Money in Your Pocket

High management fees mean less money for employees. There is a huge difference in the growth of your savings when charged 0.6% vs 1.8% in fees. Look for a plan that gives you the low rates, regardless of your company size. Pricing matters.

Pay Yourself First, Save!

Saving money feels good! People stick with the things that make them feel good, and creating health saving habits is an important way to feel secure and financially resilient in turbulent times.

Financial Stability

Today, in light of the new realities in our world, HR teams are not only expected to offer great employment opportunities, but a differentiated quality of work life that fosters connection between employees. People leaders already know that happier employees sell more, build more, recruit more, and stay with you longer. Creating a financially resilient workforce also builds a positive reputation in the marketplace.

That’s why innovative employers who offer an easy way for employees to save, grow, and track their retirement savings will have a significant impact on morale, individual resiliency, and overall well-being. If you have the right benefit partner, not only will your employees be more engaged with their own financial well-being, but you will gain better insights on how participation and education is trending in your program.

To get a demo of the Common Wealth plan, contact us.