Reflections on the Aspen Institute’s Economic Security Summit

Last week, I had the good fortune and honour to participate in the Aspen Institute’s Economic Security Summit, a four-day gathering of 40 leaders from the private, public, and third sectors who are focused on expanding prosperity in America. This year’s Summit aimed to “reconnect work and wealth” — to link people working on issues of financial security with those who are dedicated to issues of work and jobs. In this blog post, I will attempt to synthesize what I learned from this impressive group, and from a conversation that I found to be both a cause for alarm and a well of optimism. The Summit was a rare and valuable opportunity for me to step back and situate our work in broader economic and social context, to learn from innovators, thinkers, and doers from a wide range of fields, and (as the lone Canadian attending the event) to contrast the American economic debate with that of my home country.

A crisis of economic security

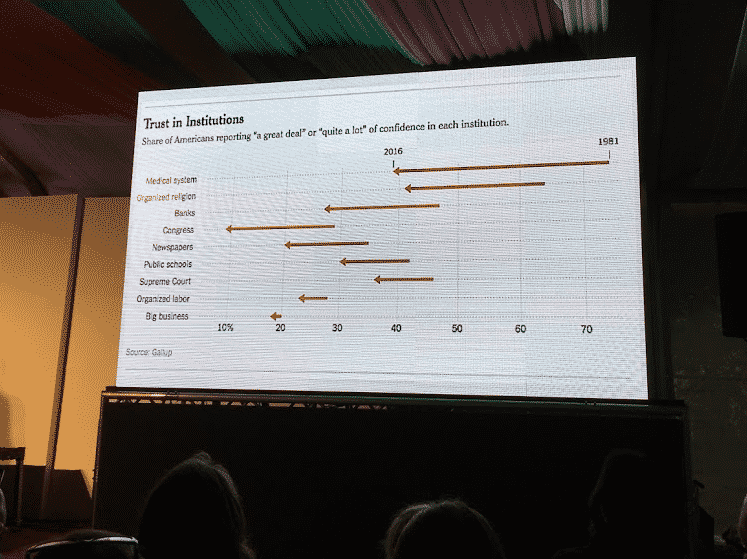

The declining economic security of the average American is increasingly seen as the biggest challenge facing the country.

This insecurity finds expression in a number of trends. Stagnant wages despite rising productivity. Vast inequality of both wealth and income, with wealth inequality now at an all-time high. Persistent inequities across racial, gender, and geographic lines. A feeling of economic and financial insecurity that preoccupies an ever wider swath of Americans.

The erosion of employer-provided pensions, health benefits, and training. The rise of non-standard, precarious work, part of the unravelling of the employer-employee compact that defined economic security for American families for decades, a story eloquently and thoroughly documented in Summit participant Rick Wartzman’s new book, The End of Loyalty. The predominance of low-wage jobs among the fastest-growing jobs in America. The capture of an ever-growing share of the nation’s productivity gains by capital rather than labour — with a disturbing share captured by the 0.1% wealthiest, an elite increasingly concentrated in the financial and technology sectors.

The rising cost of assets central to building economic security, from housing to health care postsecondary education. The volatility of American incomes. The surprising number of Americans who lack the liquid assets to sustain even a single emergency expense. The projections that young people today will accumulate significantly less wealth over their lifetimes than their parents did.

Many of us are familiar with these trends, but I’m not sure we always fully internalize their implications. When taken together and placed in broader historical context, they amount to a crisis that has caused alarm among broad array of actors and institutions, including some you wouldn’t expect.

Diagnosing the causes of these trends is more complicated. Globalization and the offshoring of American jobs to lower-cost jurisdictions is certainly one driver. The precipitous decline of organized labour, which now represents only 6% of private-sector workers, is another. The “financialization” of the economy has led to a concentration of power in Wall Street. The owners of capital, in turn, have tended to elevate short-term shareholder interests above all other interests, including the well-being of workers. The culture of American business, some argue, has shifted to the point where CEOs and corporate boards feel little obligation to advance the welfare of their workforces. Automation, which may have just begun to exert its effects on the American labour market, is another culprit. Prejudice — across lines of race, gender, and immigration status, individual and systemic — has no doubt also played a powerful role in suppressing economic opportunity in certain communities.

The problem of rising economic insecurity is understood much better when you connect two conversations that often occur in separate stovepipes: the conversation about financial well-being, on the one hand, and the one about jobs and work, on the other. The implications of the problem are not just economic. For rising economic insecurity poses a threat to democracy, and to a functioning system of democratic capitalism. This is why economic insecurity is increasingly a concern to a small but (one would hope) growing share of the American business community, and many of the people around the table at the Summit were looking to business to play a much bigger role in fixing the problem.

Admiring the peaks of Aspen and talking about how to smooth the peaks of income volatility with Even cofounder Quinten Farmer (photo credit: Aspen Financial Security Program)

Paths forward

One of the most striking and impressive things about the Summit was that the inevitable “solutions” conversation did not conclude simply with a list of things we wished government would do. Too often multi-stakeholder gatherings focus only on policy prescriptions, often detached from any concrete plan or realistic understanding of what it would take for government to enact those policies. Such an approach is not only ineffectual; it lets those who work outside of government — in business, in the third sector, in media and the academy — off the hook. As Maureen Conway, who runs Aspen’s Economic Opportunities Program, put it (I am paraphrasing here), “those with power — including all of us in the room — should not act like we lack the ability to change things. Leadership is about using that power to address the problem.” I couldn’t agree more, and the group was impressive in its willingness to accept responsibility for making change within their own nongovernmental institutions, from established businesses, to small, entrepreneurial companies, to labour unions and new worker organizations, to think tanks and universities, to nonprofits and advocacy groups.

The strength of American civil society has always impressed me. The inspiring and creative activism in response to the current political dysfunction in Washington has only served to strengthen this view. When I hear so many leaders of nongovernmental institutions willing to take action to address declining economic insecurity, it gives me hope that this civil society may be able to turn things around.

So what solutions are possible? I will highlight a few broad categories here:

- Revitalizing and reinventing institutions that represent the interests of working people. Left unchecked, the decline of American unions, at least in their current form, is likely to continue. Some of America’s largest labour organizations are already cutting their budgets in anticipation of further legal and political assaults on their ability to organize, bargain collectively, and collect dues. What tools and strategies can existing worker organizations use to protect their gains and even grow their membership? What new organizations, perhaps under a very different paradigm, can emerge to advance the interests of working people and serve as a countervailing force against corporate America and a government that has become captured (facilitated by campaign finance laws) by a narrow set of interests? Summit participant SEIU Local 775 President David Rolf has written thoughtfully and provocatively on this topic, and has helped spearhead innovative organizing efforts on behalf of working people including the Fight for $15 minimum wage campaign. The Workers Lab (whose CEO Carmen Rojas participated in the Summit) was established to fund, incubate, and scale innovations that build worker power.

- Portable benefits. There is growing momentum around the idea that perhaps employers are no longer the optimal provider of retirement, health, and other benefits for workers, especially given the rise of non-standard work, the decrease in job tenure, and the decline in company longevity. A market and regulatory structure could be created for high-quality benefits that could be accessed through work, but that would not necessarily be delivered by the employer, and that would be portable from job to job. Potential providers for such benefits could include governments, unions, associations, dedicated non-profit entities, who would work in partnership with financial institutions and other private providers. The Aspen Institute’s Future of Work Initiative, co-chaired by Senator Mark Warner, has advocated for the development of regulatory frameworks at the state and federal level to encourage such benefits. Another U.S. Senator, Elizabeth Warren, has called for the creation of such portable benefits, including for retirement security.

- Rethinking shareholder primacy. Since the 1970s, the capital markets have tended to favour the short-term interests of shareholders over all other interests. The economic security of the American worker has not been a priority in this paradigm. There is a growing movement in business, finance, and outside of these two fields, to drive a different kind of behaviour in the capital markets, and to change incentives to promote such behaviour. Organizations such as the new nonprofit Focusing Capital on the Long Term seek to shift investor and corporate behaviour away from “quarterly capitalism” towards long-term value creation. Aspen’s Business and Society Program has, for nearly two decades, worked to align business interests and investments with long-term social and environmental well-being, including working to reorient business school curricula away from shareholder primacy. Intellectual frameworks such as Michael Porter’s “shared value” approach appear to be gaining currency, even within some of America’s largest corporations. Traditional “corporate social responsibility” is being subject to both an internal and external critique for having focused too little on the wellbeing of companies’ own workers.

- New forms of assets or delivery challenges for asset building. The asset building movement, now several decades old, seeks to make it easier for lower- and moderate-income people to build wealth and achieve economic security. Those within and around that movement are now thinking through what new kinds of assets — or ways of democratizing access to assets — might make this easier. There is growing momentum behind the creation of high-quality financial products that combine addressing both short- and long-term financial needs (see, e.g., Aspen’s recent paper on combining retirement plans with short-term “sidecar” savings in a single account). Others are focused on expanding access to business ownership, including facilitating greater employee ownership of business through policy and other levers (see, e.g., Summit participant Joseph Blasi’s “Having A Stake” paper for Third Way, and Project Equity, whose co-founder Hilary Abell participated in the Summit).

- Policy and regulatory levers. The role of government and public policy is obviously critical to reducing economic insecurity. I give short shrift to it here because it deserves much more space than this blog post can afford. The $15 / hour minimum wage campaign has resulted, to the surprise of many, in policy change in Seattle, New York, Alberta, and Ontario, and continues to build momentum. Another topic is the employee versus contractor classification issue, including the possibility of a third, intermediate category that would balance the independence of contract work with the security of employment. Governments can also play a role in promoting worker voice, making it easier to form and build both traditional and new organizations to protect worker interests. Progressive taxation, public education, and tools to democratize access to business ownership are also critically important levers. So, particularly in a US context, is health care, a field where the next few years of policy reform is likely to generate economic insecurity on a massive scale, as Washington rolls back Medicaid and Medicare. As several Summit participants rightly pointed out, aspirational policy proposals have little utility if not connected with the organizational and power structures to make them a reality. The conversation about policy must be linked, in other words, to political organization and plans to shift the balance of power.

Reflections on the Summit and implications for our work

The Summit helped shift and clarify my thinking about the work we do at Common Wealth — both today and in the future. First, it helped sharpen the reasons why we do this work. We do it not only to strengthen retirement security, although that is certainly the focus of our efforts. We do it to reduce inequality and contribute to a shift in the balance of power away from traditional capital (e.g., financial institutions) and towards working people and communities. The model we favour — high-quality portable retirement plans sponsored by unions, associations, and other community-based organizations — not only provides lower- and moderate-income workers with access to retirement security. The model also provides a tool and a benefit to the sponsoring organizations themselves to assist them in maintaining and growing their communities. In this sense the model yields a double dividend: stronger financial security for workers and stronger organizations that represent the interests of workers and communities.

Both parts of the double dividend are important, and the Summit reinforced for me that we need to work on both at once. We can do more to incorporate human-centered design, behavioural insights, and the lived experience of lower- and moderate-income workers into our retirement plans. We also want to deepen our collaboration with the organizations we serve to ensure these plans are designed and distributed in a way that benefits and strengthens the communities they represent and the movements they are working to build.

The debate around portable benefits has more momentum in the US than in Canada, but remains largely at the concept phase. Few concrete examples of portable benefits appear to exist, although there are some longstanding examples among construction unions and Hollywood screenwriters. Regulatory and legislative frameworks to facilitate such benefits are in their infancy, although advancements are being made in Washington, New Jersey, New York, San Francisco, and in the US Senate. Progress on both these fronts is necessary in order for the idea to catch on. There is a significant opportunity to design and pilot such portable benefits programs, whether for retirement, health, or other worker benefits. Our own focus at Common Wealth, of course, will be on designing, piloting, and scaling up high-quality, portable retirement plans, in partnership with unions, associations, and other community-based organizations — and even, potentially, groups of “high-road” employers that want to show leadership in building financial security for their employees. We can also work to develop the broader “ecosystem” around portable benefits, including advocating for and advising on public policy frameworks, and supporting worker- and community-oriented organizations, both established and new, that want to find ways to deliver high-quality benefits and protect workers in a changing labour market.

The reputation of the pension, as an institution, is not in good shape in America. Poor stewardship of pension plans in both the public and private sectors, coupled with the precipitous abandonment of defined-benefit pensions by corporations, has created the impression of the pension as a dinosaur, a relic of a bygone era that can’t and shouldn’t be resurrected. Persuading Americans that well-run pensions can be the most efficient vehicles for delivering retirement security can be an uphill battle, despite the fact that pensions, in their highest form, can be examples par excellence of the very portable benefits American advocates are seeking. Championing pensions, as a category, is easier in jurisdictions, such as Canada and the Netherlands, where there are more living examples of modern pensions that are well-governed, competently managed, and sustainably funded. And yet, it is for this very reason that building real-life examples of efficient, worker-owned, collective retirement arrangements in the US holds so much promise. The early success of new collective models, whether sponsored by governments, unions, associations, or groups of progressive employers, could have a domino effect, proving the value of a model many now think is no longer possible, and prompting further collective action. Even if the reputation of the traditional, employer-sponsored defined-benefit pension plan may be beyond repair among many Americans, that of collective retirement benefits can be revived with the right innovation, momentum, and support.

Finally, the Summit helped me think more expansively about the kind of business we are in. Yes, we are in the business of helping people retire with dignity. But, more broadly, we are also in the business of building economic security, and allying with organizations that are seeking to do the same for the benefit of workers and their communities. Deepening our partnerships within this broader community — and aligning our interests and incentives with theirs — will be critical to solving the problem we seek to address. In his timeless “Letter from a Birmingham Jail,” Martin Luther King, Jr., wrote of “an inescapable network of mutuality.” Businesses, like ours, that seek to address large and pressing social problems, must work not in isolation but in community. Gatherings like the Aspen Institute’s Economic Security Summit help make this possible.