Personalized investing

As the fastest-growing group retirement platform in Canada, our goal is to make it easy for members to plan, invest and grow their savings and build greater financial security in retirement.

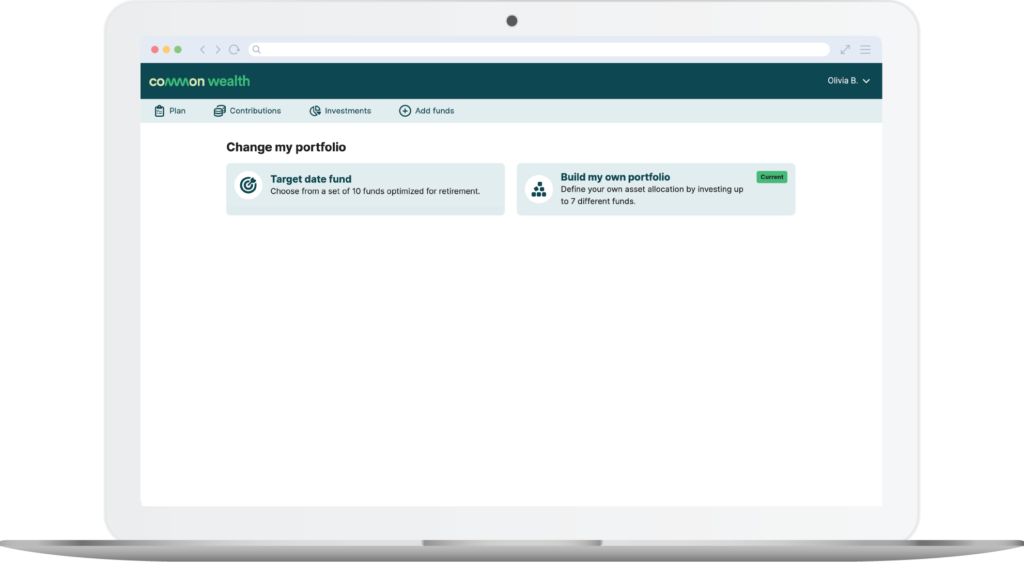

As part of our commitment to deliver innovative member experiences, we’ve expanded our investment options and added a new feature called Build My Own Portfolio.

Build My Own Portfolio gives members a user-friendly way to allocate their assets in line with the investment risk they wish to take—using a low-cost, diversified, actively managed strategy.

What are the investment choices in a Common Wealth plan?

Target date fund

Most people don’t have the desire or expertise to manage their own investments and want a proven, professionally managed strategy to grow their saving for retirement. So, we’ve taken the guesswork out of investing by suggesting an age-appropriate BlackRock® target date fund (TDF) for members.

TDFs are a smart choice for retirement. They are designed to take more investment risk when you’re young and automatically get more conservative as you near retirement. It’s ideal for most members, who want to set-it-and-forget-it and let the plan work for them.

There are 10 target date funds included in the Common Wealth plan, and members can go with the suggested fund or select their own.

Build My Own Portfolio

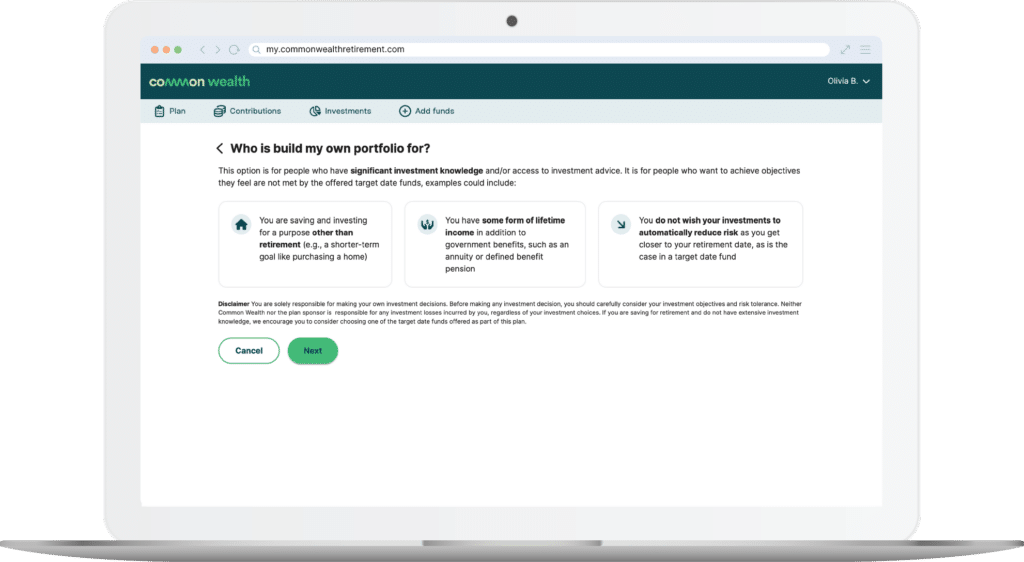

Build My Own Portfolio gives members an easy way to personalize their portfolio and define their own investment risk level. This is helpful for members who are saving for a shorter-term goal like a home purchase and want less risk, or for those who already have retirement income set aside and want to take a little more risk.

Build My Own Portfolio is available to members based on their employer’s plan design.

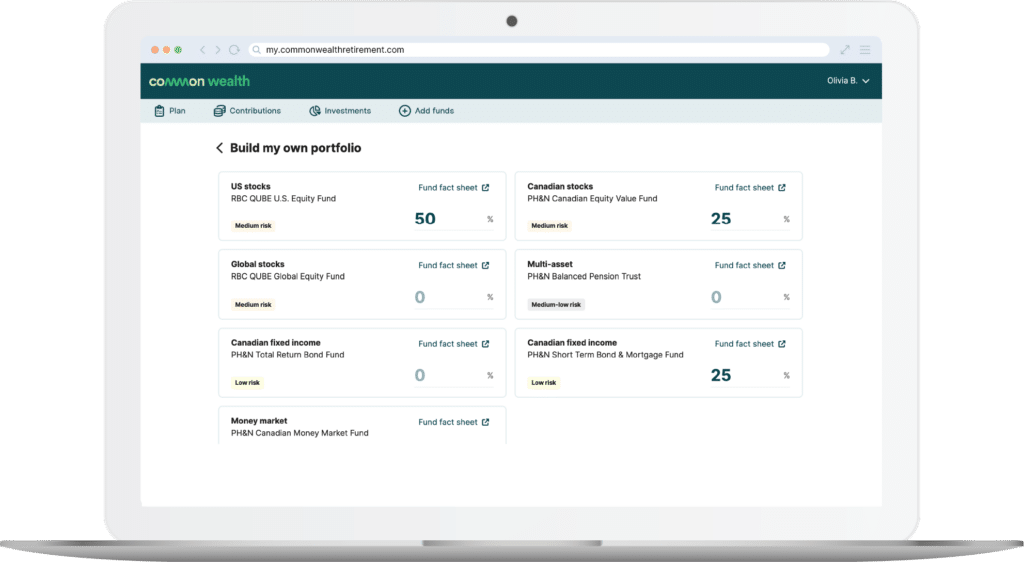

How does it work?

To build a portfolio, members simply add the percent they wish to allocate to each fund. Investments can be made across a variety of asset classes. As you allocate your investment, it will indicate your risk level.

All funds in Build My Own Portfolio are managed by RBC Global Asset Management, Canada’s largest asset manager. Every quarter, funds are automatically rebalanced to ensure the asset mix matches the target allocation.

—

About RBC Global Asset Management

RBC Global Asset Management, a division of RBC, is a global asset manager with over $564 billion[1] in assets under management. It ranks as the largest asset manager in Canada[2] and serves a wide range of institutional clients, including pension funds, endowments, insurers, and high-net-worth individuals.

1 As of April 2023

2 See Benefits Canada, 2023 Top 40 Money Managers Report. RBC GAM’s #1 ranking based on total assets as of Dec 31, 2022.