modern GROUP RRSP & TFSA PLANS

The Common Wealth Advantage

The industry's first low-fee digital retirement platform that supports Canadians for life

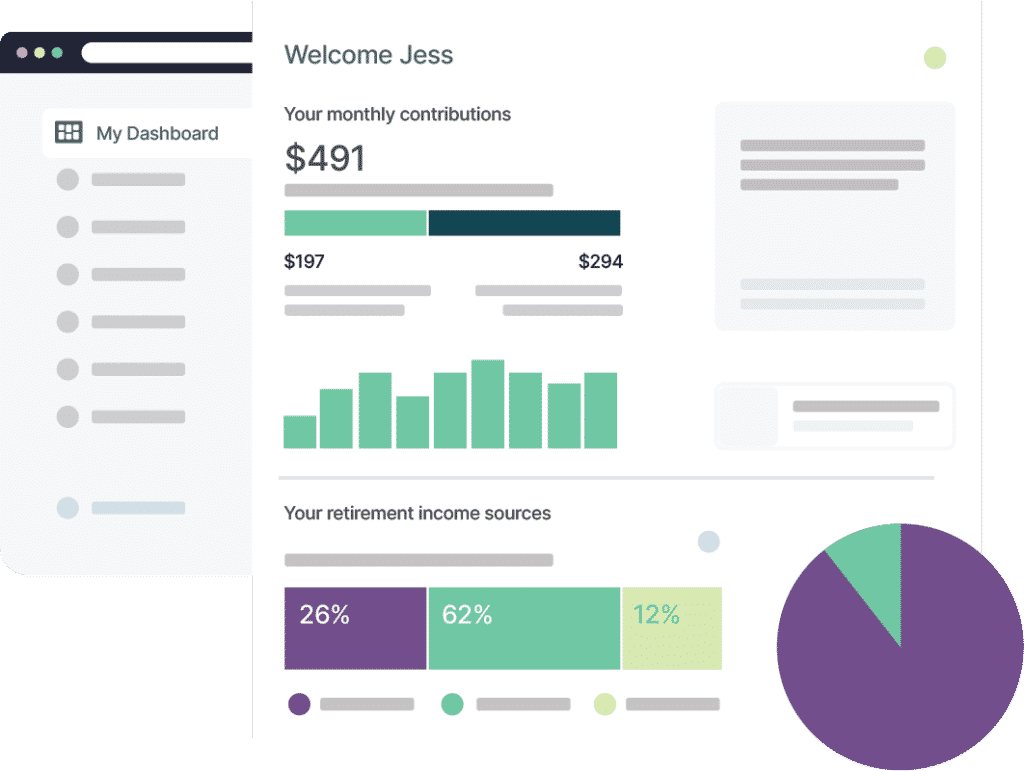

A digital retirement plan for today's workforce

A retirement plan should be more than just an investment account. Common Wealth offers easy and affordable workplace retirement plans that help members maximize their savings through built-in planning, smart in-app suggestions, and low-fee investments tailor-made for retirement.

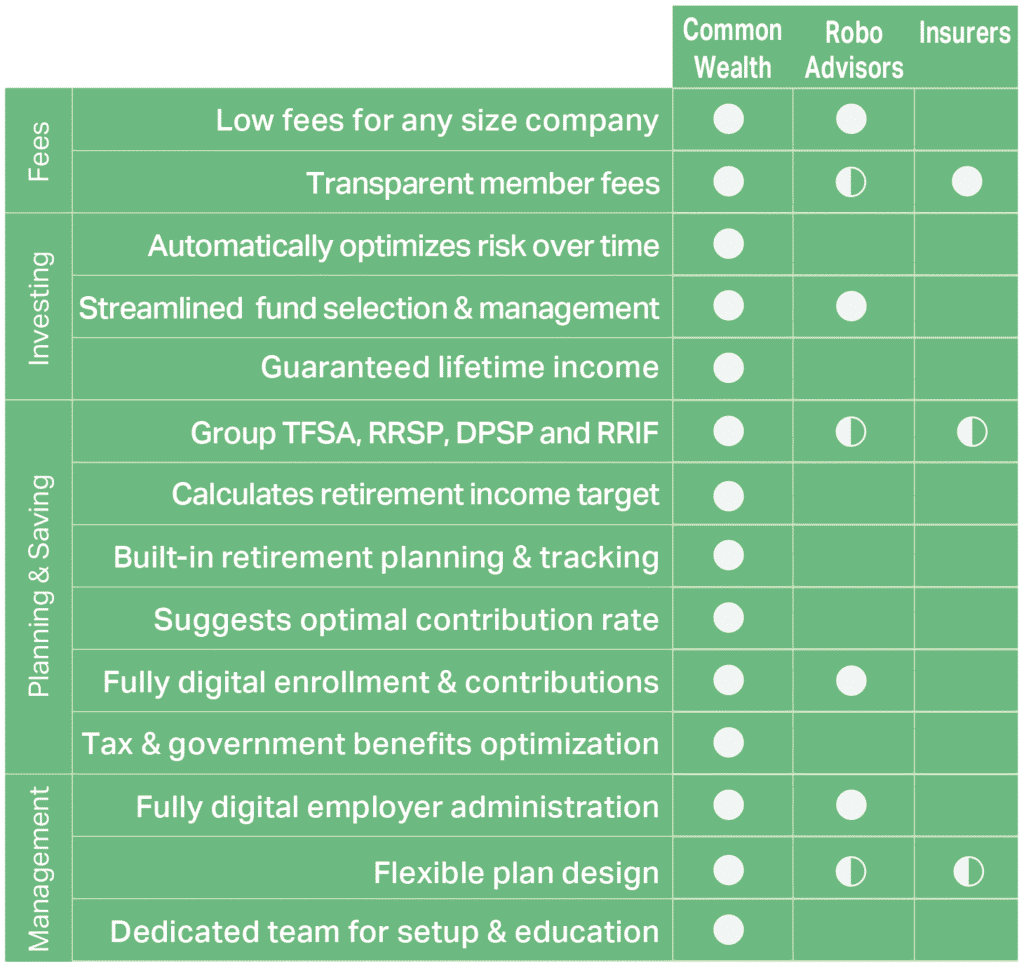

What's innovative about Common Wealth?

Common Wealth is the only solution on the market with built-in planning, so you know how much you’ll need in retirement income, how much to expect from government benefits and how much to save, with a contribution schedule to help get you there.

| Low fees (more money for members) |

| Built-in planning (suggests how much you need & how much to save) |

| RRSP, TFSA, DPSP, RRIF in one plan |

| Matches members to an age-appropriate BlackRock target date fund |

| Automatic portfolio balancing & risk adjustment |

| Guaranteed lifetime income (annuities) in the plan |

| Tax & government benefit optimization |

| Easy digital setup, enrollment & maintenance |

| Flexible matching options |

| Dedicated support & team education |

| Common Wealth | Robo Advisors | Insurers |

|---|---|---|

Enhance retirement wealth by as much as

50%

The Pension Research Council at the Wharton School found that plan members using low-cost target date funds, such as the ones through the Common Wealth plan, earned 2.3% higher returns each year, which can enhance retirement wealth by as much as 50% over 30 years.

MEMBER FIRST

Why you'll love us

Workplace plans are highly valued by employees as most Canadians have to choose between investing in a high-fee bank RRSP that chews up a significant amount of their earnings, or learn to manage their own investments. With Common Wealth, your team gets the best of both worlds: low fees and a professionally managed investment portfolio.

Lower fees than a bank RRSP

Our fees are up to 70% less than what the average Canadian investor pays, which means more money in our members’ pocket.

Low-effort setup & maintenance

Our digital platform and payroll integration make setup, enrollment and ongoing monthly contributions quick and easy.

Affordable for any size company

We’ll help you structure a flexible contribution and matching plan that works for your company culture and your budget.

No investing knowledge required

We offer professionally managed target date funds from BlackRock® that automatically rebalance and adjust risk to become more conservative as you near retirement.

From the Blog

Wealthsimple Work vs Common Wealth Group Retirement Plans

Manulife & Sun Life & Canada Life vs Common Wealth

Let's talk

Talk to one of our retirement specialists about a group RRSP/TFSA for your team.